Shanghai's real estate sector in doldrums

Updated: 2008-02-01 11:23

Investment in Shanghai's real estate market is expected to grow less rapidly and become more vulnerable to policy uncertainties in 2008, according to several large real estate service providers.

Real estate investment saw a slowdown in the fourth quarter last year, with only one notable sales transaction completed in the city, after the government implemented the land appreciation tax and imposed additional restrictions on foreign investment in the sector, according to Jones Lang LaSalle.

"Increasing monetary control and tightening policies are bringing more uncertainties, particularly to the investment market," said Lee Hingyin, director of Research & Consultancy at Colliers International (Shanghai).

"Increasing monetary control and tightening policies are bringing more uncertainties, particularly to the investment market," said Lee Hingyin, director of Research & Consultancy at Colliers International (Shanghai).

"The investment market may feel the pinch, and it is likely that foreign investors will be more vulnerable to these policy changes this year," said Lee, adding that he expects more severe measures, which will significantly cool down the investment market.

James MacDonald, senior manager of Research at Savills China, however, said: "In the institutional investment market, it's not necessary that new policies will be introduced and will affect the market in a big way. Instead, it is the more stringent implementation of previous regulations that has to be watched."

"The government's tighter monetary policy this year is expected to have a negative impact on the real estate investment market, which is highly dependent on bank loans," said Chen Sheng, director of the China Index Academy, which tracks property prices.

Wang Qing, an economist at Morgan Stanley Asia Ltd, said in a report that sectors with a high debt-asset ratio, such as real estate, tend to experience larger declines in fixed-asset investment growth after credit tightening. The debt-asset ratio of the real estate sector is over 70 percent.

Liu Shiyu, deputy governor of the People's Bank of China, said the government will strengthen commercial real estate management and adjust the real estate credit structure to prevent risk.

A survey was conducted by the State Administration for Industry and Commerce in December on foreign investment in China's real estate sector. The move came on the heels of the Ministry of Construction opening a research meeting on the implementation of existing policies restricting foreign investment in real estate.

"Many foreign investors would probably shift to second- or third-tier cities, including Chengdu, Chongqing and Hangzhou, to avoid fierce competition and dodge the stricter restrictions on foreign investment in the first-tier cities such as Shanghai," said Kenny Ho, head of research at Jones Lang LaSalle (Shanghai).

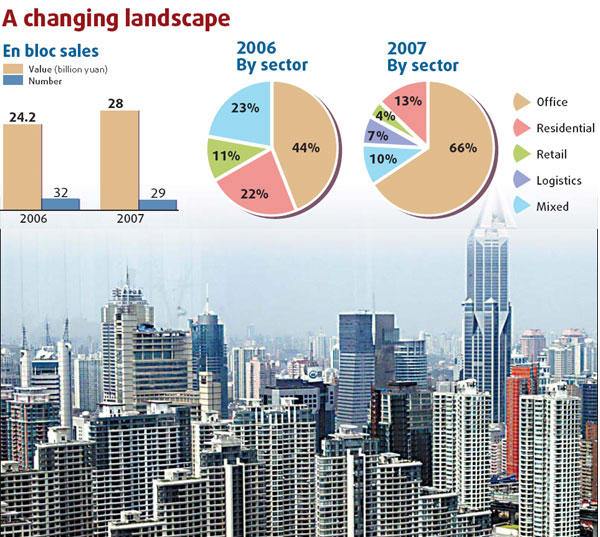

Acquisition in the city amounted to 28 billion yuan ($3.89 billion) in 2007, up only 15.7 percent from the year before, according to statistics from Jones Lang LaSalle. Office investment accounted for 66 percent of the total, followed by residential (13 percent), mixed projects (10), logistics (7) and retail (4).

|

||

|

|