Index rises 1.6% on stamp tax comment

By Ding Qi (chinadaily.com.cn)

Updated: 2008-03-06 17:16

Updated: 2008-03-06 17:16

Mainland stocks went up more than one percent on Thursday, echoing the financial regulator's comments on stamp tax, but worries still remain that Ping An Insurance's record share sale could further strain the capital supply.

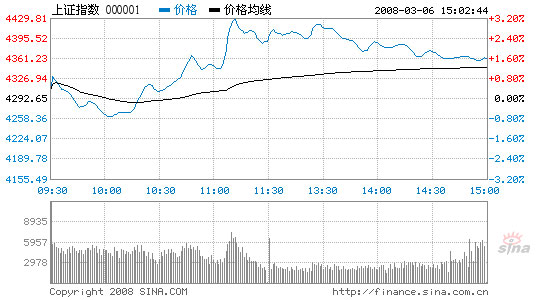

Shanghai Composite Index

Source: sina.com.cn

Minister of Finance Xie Xuren told a press conference today that the government will seriously consider adjusting its capital market tax policy. "We have taken notice of comments on the Internet regarding the adjustment of capital market taxation, and we are seriously considering it."

Encouraged by the remarks, the benchmark Shanghai Composite Index, reversing yesterday's loss, opened 18 points higher at 4,310.35. Ping An's dramatic surge fired up the whole financial sector and pushed the index above 4,400 points in the morning session. Declining a bit later on profit taking, the market closed at 4360.99, up 1.59 percent.

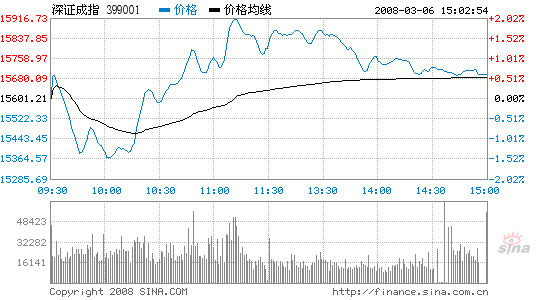

The Shenzhen Component ended up 0.61 percent to 15,696.13 points; while the CSI300 Index, covering major stocks in both markets, gained 1.22 percent and closed at 4,685.03 points.

Transaction value of the two markets totaled 199.7 billion yuan (US$28.09 billion), slightly larger than Wednesday's figure.

Also on Wednesday evening, Ping An shareholders approved its revised refinancing plan, which includes issuing about 80 billion yuan worth of shares and 40 billion yuan of convertible bonds. Although the plan's financing scale shrunk by 40 billion yuan from the previous one, most individual investors fear that the move, if imitated by other large caps, will suck billions of yuan out of the stock market and further weaken investor sentiment.

Shenzhen Component Index

Source: sina.com.cn

However, institutional investors might view the deal in a positive way, as the insurer's stock price rallied ten percent before closing at 72.38 yuan, 5.28 yuan higher than Wednesday's close.

Encouraged by the surge, financial stocks boomed. China Life edged up 4.93 percent to 38.93 yuan, and China Merchants Bank climbed to 33.35 yuan. Obsessed by the recent spate of refinancing plans and rumors, the whole financial sector lost some ten percent in market value over the past month.

Benefiting from the steady appreciation of the renminbi, the papermaking sector also performed well led by Yueyang Paper, a large papermaking group in Hunan Province, whose shares surged by the daily limit of ten percent.

In contrast, the agriculture and growth-enterprise related sector closed lower after soaring sharply in the past few days.

Zhou Xiaochuan, governor of the People's Bank of China, said today that the government will measure the impact on the capital market when mulling interest rate hikes.

According to Shang Fulin, chairman of the China Securities Regulatory Commission, preparations for China's first growth enterprises board are close to completion, and a draft of its management regulations will be released as early as in April.

|

||

|

|