|

BIZCHINA> Center

|

|

Related

Slowing profit growth preoccupies investors

(China Daily/Agencies)

Updated: 2008-10-15 14:14

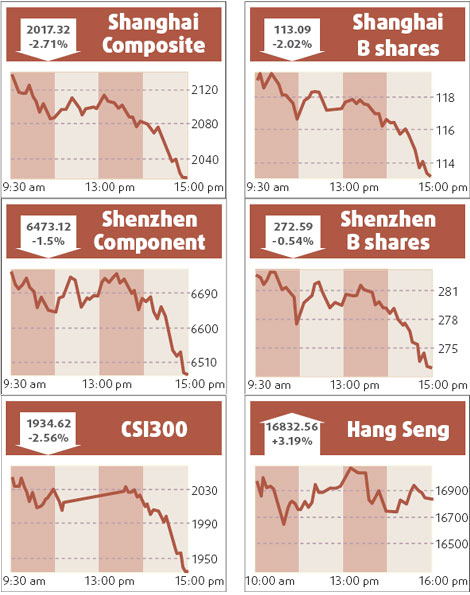

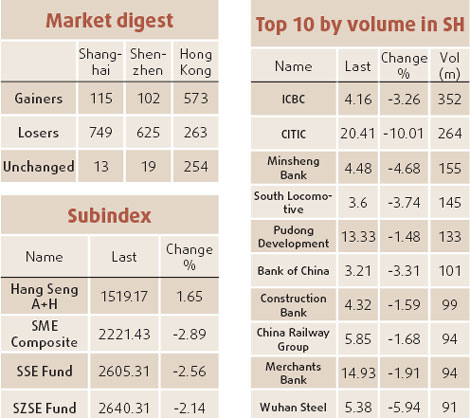

China's stock market fell yesterday, greatly underperforming other markets in the region for a second straight day, as worries about slowing corporate profit growth outweighed an easing of the global financial panic. The Shanghai Composite Index, which had opened yesterday 3.16 percent higher, closed down 2.71 percent at 2017.321 points in moderate turnover. It far underperformed the MSCI index of Asia-Pacific stocks outside Japan, which was up over 6 percent after governments in the United States and Europe pledged to pour money into struggling banks. China outperformed other Asian markets last week because of a Chinese government scheme to support stocks, including purchases of shares from the market. But analysts said there was concern that while the government might try to keep the Shanghai index above the psychologically important level of 2000 points, it might not take further steps to push the market up. Meanwhile, investors fear poor corporate earnings growth as the Chinese economy slows. Banks were particularly weak yesterday, with Industrial & Commercial Bank of China, the biggest bank, down 3.26 percent at 4.16 yuan. "Third-quarter earnings don't seem very good, and the market is very sensitive. So people are taking profits," said Chen Huiqin, analyst at Huatai Securities. Companies are announcing third-quarter earnings through the end of this month. Turnover in Shanghai A shares expanded to one-week high of 53.2 billion yuan yesterday from 41.8 billion yuan on Monday, but it was moderate compared to levels early this year. Losing Shanghai A stocks outnumbered gainers by 774 to 150. The average premium of mainland-listed A shares over Hong Kong-listed H shares in the same Chinese companies hit six-month highs above 40 percent last week as the mainland market temporarily outperformed the region. Some investors feel uncomfortable with premiums at such high levels. The average premium, which fluctuated around 20 percent in August and September, dropped to 23 percent yesterday. Brokerage shares were big losers after Guoyuan Securities said its net profit shrank 76 percent to 448.7 million yuan in the first nine months of this year because of the market's slump during that period. Among gainers, non-ferrous metals shares were particularly strong as global metals and energy prices rose on hopes that an easing of the financial crisis would support demand for resources.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 连江县| 陈巴尔虎旗| 简阳市| 白朗县| 大连市| 津市市| 梨树县| 安福县| 永修县| 绥棱县| 大港区| 神木县| 韶山市| 孟村| 南安市| 祥云县| 大安市| 鄂托克旗| 姜堰市| 封丘县| 来宾市| 清苑县| 运城市| 新干县| 阳原县| 同江市| 阜城县| 高陵县| 什邡市| 额敏县| 吴江市| 临澧县| 福泉市| 昌江| 新疆| 曲阳县| 乌审旗| 阳城县| 泗阳县| 漳浦县| 黑山县| 贡觉县| 奉节县| 阳谷县| 鄂州市| 麦盖提县| 成都市| 本溪市| 马龙县| 报价| 高安市| 百色市| 沁阳市| 古丈县| 巴青县| 扶绥县| 锦屏县| 普宁市| 宁阳县| 枞阳县| 介休市| 东兴市| 德惠市| 蒲城县| 永年县| 年辖:市辖区| 祁阳县| 临城县| 沂南县| 孝昌县| 扶沟县| 延川县| 西乡县| 临沧市| 普格县| 福泉市| 田阳县| 商都县| 邓州市| 竹北市| 荣成市| 芷江|