|

BIZCHINA> Center

|

|

US treasury bonds 'still the best option'

By Xin Zhiming (China Daily)

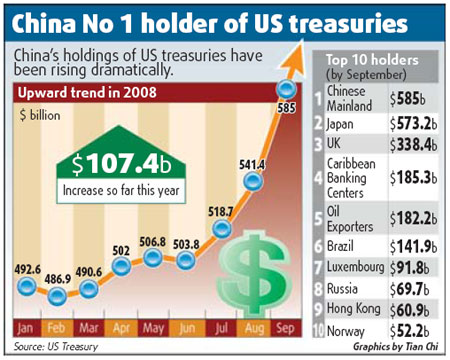

Updated: 2008-11-20 09:46 China is likely to continue increasing holdings of US treasury bonds even after becoming the No 1 holder because it is the best way to deploy its $1.9 trillion foreign exchange reserves, economists say. On Monday, US Treasury data showed that China had replaced Japan to become the top holder of US treasury debt in September.

With a $43.6 billion increase in holdings of US treasury securities in September, China's overall holdings amounted to $585 billion. Japan cut its holdings to $573 billion from $586 billion in August. Net foreign purchases of long-term US securities totaled $66.2 billion in September, up from $21 billion in August and $18.4 billion in July. Treasury data suggests that foreign investors still regard the US as a relatively better place to invest when markets worldwide are crumbling, analysts said. "That's why China has increased its holdings," said Dong Yuping, senior economist at the Institute of Finance and Banking affiliated to the Chinese Academy of Social Sciences. As the US financial crisis worsens, Washington is in dire need of capital to fund its massive market rescue plan; but some domestic economists argue that China should not use its foreign exchange reserves to purchase US bonds for fear that it may incur huge losses.

"But China may not have many options," Dong said. The US economy, though hemorrhaging from the crisis, remains the largest and strongest; and the EU and Japan are not yet a serious challenge to US pre-eminence. Investment in dollar assets, therefore, carries the least risk, he said.

"China and the US are in the same boat," he said. "You may not like it, but China has to move along this path," said Yan Qifa, senior economist with the Export-Import Bank of China. And now that many countries are increasing holdings of US treasury bonds, China's potential returns from the bonds will increase, said Chen Gong, chief economist and chairman of Anbound Group, a Beijing-based consulting firm. "So China may continue to increase its holdings," he said. However, some experts argue that Beijing use its considerable financial leverage to set conditions such as the US opening its financial markets more to Chinese funds, and allowing exports of high-tech products to China. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 浦江县| 麻阳| 肥西县| 同仁县| 贵南县| 宜春市| 轮台县| 静安区| 乳山市| 胶州市| 厦门市| 平度市| 漯河市| 紫金县| 沾化县| 永春县| 东台市| 阿拉善右旗| 滦平县| 龙岩市| 枣强县| 镇巴县| 巴林右旗| 韶山市| 古丈县| 隆子县| 平遥县| 麻江县| 葫芦岛市| 上思县| 达拉特旗| 类乌齐县| 樟树市| 沈丘县| 富平县| 勃利县| 东城区| 唐海县| 两当县| 彰化县| 上高县| 冷水江市| 南江县| 达孜县| 黔江区| 额尔古纳市| 陆丰市| 阿勒泰市| 徐水县| 娱乐| 高雄县| 油尖旺区| 子洲县| 惠东县| 桦南县| 文昌市| 抚远县| 东兰县| 阜新市| 商丘市| 武安市| 汶上县| 宝兴县| 五峰| 张家港市| 湖北省| 彭州市| 古蔺县| 大方县| 宜良县| 咸宁市| 娄底市| 杭州市| 准格尔旗| 扎赉特旗| 徐水县| 天气| 甘洛县| 团风县| 休宁县| 栾城县| 惠州市|