|

BIZCHINA> Top Biz News

|

|

Gome may sell stake to stay afloat

By Ding Qingfen (China Daily)

Updated: 2008-12-17 08:08

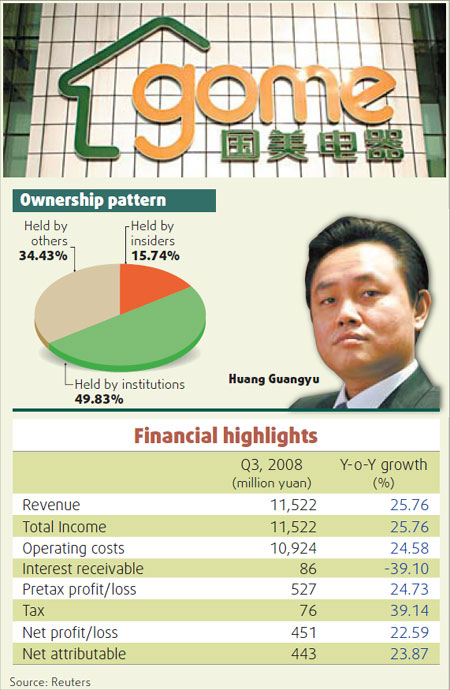

Troubled Chinese electrical retailer Gome may offload part of its stake to outside investors to shore up its cash flow and counter the retail market slowdown, according to analysts.

Besides bank loans, there have also been media reports that the company is already facing difficulties in getting short-term credit from suppliers. According to a report from Financial Times, Gome is holding preliminary talks with overseas equity firms over possible sale of a strategic stake. Gome's spokesperson He Yangqing did not deny the report, but refused to comment on the same citing corporate policy.

"The company had been facing the problem of (sluggish) cash turnover from the middle of the year, much before the scandal broke out," said Wu Meiping, senior researcher, Essence Securities. "Gome has also been losing favor among the electronics suppliers especially since Huang was arrested late last month," Wu said. According to the FT report, Gome's executives have recently talked to "several overseas rivals for an investment", but these are "early days and all sides are feeling their way around". The Huang probe and suspension of its shares have not gone well with the suppliers and this in turn has squeezed cash flow for a short period, said Wu. Tian Huilan, analyst, First Capital Securities, said the long-term prospects for Gome look dim. "I have doubts on whether the company can weather a slowing retail market by selling stake to foreign investors." Analysts said the company's reckless expansion spree in the last few years have put it under severe financial stress. While its main rival Suning adopted a steady expansion path, the aggressive Gome opened outlets even in far-flung locations and in many cases at high rentals, they said. The company's shares have also been falling continuously over the last few months. Gome shares closed on Nov 21 at HK$1.12, with a market capitalization of HK$14.3 billion. Just a year back the share prices were as high as HK$21. Its trading has been suspended since Nov 24. "I'm concerned at how much share Gome and Huang would sell and whether the company would lose its influence on the retail market," said Tian. Huang holds around 36 percent stake in Gome, with second largest shareholder JP Morgan owning 8.88 and the third largest Morgan Stanley 8.17 percent. Founded in 1987 from a small shop, Gome has grown to become the largest electrical retailer in China with over 1,300 stores. Its closest rival Suning in comparison had just 784 stores at the end of September. Gome has a 40 percent share of the electrical retail market in the country, while Suning holds a mere 7 percent. Analysts said that the shareholding pattern in Gome may act as a deterrant for any stake sale as it would need approval from the majority shareholder Huang. It is also unclear on how the probe findings would impact the company in the near future. To cope with the crisis, Gome has appointed its CEO Chen Xiao as acting chairman. But the company is still vulnerable to fresh bouts of turbulence, analysts said. According to Wu, the priority for Gome is to improve cash turnover and win back consumers', suppliers and market confidence.

(For more biz stories, please visit Industries)

|

||||||

主站蜘蛛池模板: 湘潭市| 小金县| 涿鹿县| 桦南县| 宁化县| 会泽县| 利辛县| 得荣县| 房山区| 攀枝花市| 长汀县| 长治市| 长岭县| 南开区| 长汀县| 通辽市| 辰溪县| 泰和县| 略阳县| 长岭县| 盐边县| 宝清县| 图木舒克市| 大悟县| 新津县| 华宁县| 蓝田县| 儋州市| 武鸣县| 五河县| 永昌县| 开鲁县| 嵩明县| 独山县| 时尚| 海南省| 泽普县| 吉水县| 陇西县| 张家港市| 牙克石市| 略阳县| 卢龙县| 雷山县| 双牌县| 靖江市| 襄汾县| 连州市| 舟山市| 白水县| 古交市| 古丈县| 蚌埠市| 仪陇县| 怀柔区| 诸暨市| 池州市| 集安市| 淮南市| 安乡县| 墨江| 溆浦县| 布尔津县| 蒲江县| 天峨县| 牡丹江市| 武威市| 陕西省| 乌拉特后旗| 五常市| 金平| 余姚市| 老河口市| 句容市| 永济市| 云霄县| 四会市| 洞头县| 体育| 麻江县| 郸城县| 德州市|