|

BIZCHINA> Top Biz News

|

|

Final touches for deposit insurance

By Hu Yuanyuan (China Daily)

Updated: 2008-12-19 08:00

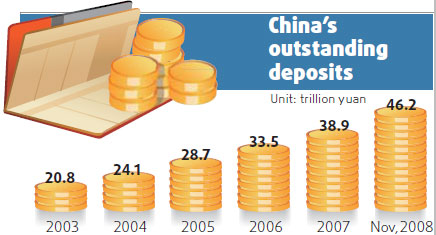

"The plan will be passed next year at the latest," he said. Central bank statistics show that total bank deposits amounted to 46.2 trillion yuan at the end of November, up 19.94 percent from a year earlier. Although it is generally understood that the central government will stand behind any bank, there had been runs on a few small banks in Hainan and Guangdong provinces in the past few years. These minor incidents subsided quickly, but there are obviously lingering worries in the minds of many depositors as the global financial crisis continues to worsen. "There is no sign of irregular cash withdrawals on the mainland, but it's quite necessary to strengthen people's confidence in the financial system," said Sun Minjie, executive vice-president of Bank of East Asia's mainland subsidiary.

"The long-awaited deposit insurance scheme on the mainland needs to be established soon." The central bank has been studying ways to shield depositors against risks arising from bankruptcy of financial institutions for about 10 years. In April 2004, the central bank set up a deposit insurance division at its financial security bureau. Last year, the Chinese central bank signed a Memorandum of Understanding with the US Federal Deposit Insurance Co on cooperation in deposit insurance. "The launch of the deposit insurance system, on one hand, could boost people's confidence, especially at such trying times," said Zhu Junsheng, an insurance researcher with the Capital University of Economics and Business. "It can also allow badly managed banks to go out of business without requiring the government to pick up the bill," Zhu added. According to Zhang of the central bank, all the deposit-taking financial institutions must take part in the proposal, which would cover 98 percent of all deposit accounts. "But the most urgent task is to find ways to cover the losses of those rural cooperatives destroyed in the Wenchuan earthquake," said Zhang. A recent survey by the central bank shows that over 98 percent of deposit accounts have balances of below 200,000 yuan each, which could be the ceiling set by the proposal. The United States was the first country to establish an official deposit insurance system during the Great Depression in 1934. Since then, nearly 100 other countries have introduced similar plans to protect depositors.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 黄大仙区| 胶州市| 阿巴嘎旗| 南陵县| 扎囊县| 肥乡县| 达日县| 揭阳市| 安徽省| 潼关县| 合作市| 巨野县| 大埔区| 扶余县| 霸州市| 四平市| 额济纳旗| 乌兰察布市| 沾益县| 沙雅县| 蓬莱市| 康乐县| 鸡泽县| 桑植县| 北碚区| 宜兰县| 政和县| 奇台县| 彰武县| 江西省| 九江县| 赣州市| 上饶市| 长治市| 潼关县| 阿鲁科尔沁旗| 运城市| 岗巴县| 文化| 大姚县| 山东| 东宁县| 清远市| 新郑市| 得荣县| 宁津县| 绵竹市| 韶关市| 大悟县| 平南县| 滨州市| 长岭县| 巢湖市| 三明市| 浪卡子县| 四子王旗| 子长县| 曲沃县| 隆子县| 青神县| 宣威市| 伊春市| 苏州市| 龙江县| 阿勒泰市| 同心县| 安仁县| 遂溪县| 衡南县| 恭城| 莆田市| 镇康县| 辉南县| 新宁县| 炎陵县| 扶风县| 永胜县| 马公市| 黄陵县| 博爱县| 东光县| 利津县|