|

BIZCHINA> Top Biz News

|

|

Overseas Chinese eye motherland for jobs

(China Daily)

Updated: 2008-12-29 07:50

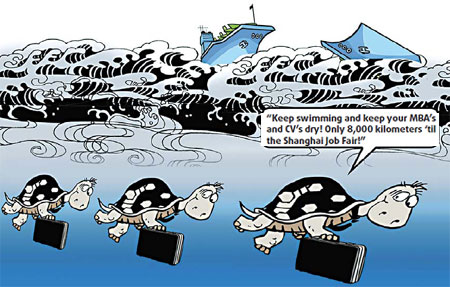

They were the "gold-collar" workers: highly educated Chinese people working on Wall Street. Now, they are known as "sea turtles" as they head home to escape the financial storm. Nearly 1,000 would-be turtles in business suits packed the ballroom of a New York hotel on December 13, where they pitched themselves at a job fair for opportunities in Shanghai, China's financial hub.

"The crisis in the US is very severe. We're having a serious shock that will reshape the landscape of Wall Street," says Shaw, who is looking for jobs that match his expertise in model-driven stock selection. Shaw, who said he was in his 40s, currently does stock-picking at a hedge fund and has also worked at Scudder Investments, Goldman Sachs and Bank of America. Like many at the fair, Shaw is attracted to China's relatively unscathed financial sector and still healthy growth prospects. "As a new market, China is full of opportunities," the Shanghai native told reporters. The worst financial crisis in decades has left the US economy mired in a recession since December 2007, claiming more than 2 million jobs so far. New York's securities industry has lost 16,000 jobs and could lose a total of 38,000 by next October, while another 10,000 could be axed in related fields such as banking, according to New York's state comptroller. Some cities and firms in China are quick to exploit the opportunity to lure back native talent. The fair was led by the Shanghai municipal government and organized by about two dozen banks, insurers and securities firms from the city, including the Shanghai Stock Exchange, one of the two stock exchanges in the Chinese mainland. New York was the last stop in the delegation's efforts to poach back up to as many as 170 seasoned specialists in such fields as risk management and private wealth management. Its two earlier recruiting sessions in London and Chicago attracted a total of 1,200 people. Earlier this month, Nanjing in Jiangsu province in East China held similar events in several major cities in the US, which attracted hundreds of people. Eager to become a major player in the world economy, China is working hard to expand its talent pool and overseas Chinese, who offer both international experience and language and cultural skills, have often become an ideal option for local firms. Of the 1.2 million Chinese people who have gone abroad to study in the past 30 years, only one fourth of them have returned, according to the Chinese government. It's been a tough year for many of the "gold-collar" Chinese on Wall Street. Some have lost their jobs and most have seen their personal wealth shrink. "This is an unusual time. For some, this is their first experience of being unemployed and they're under enormous pressure," says Tony Tang, president of The Chinese Finance Association (TCFA), a nonprofit group based in New York. "Now these Chinese companies are giving out positions and many are contemplating it." Optimism over China To be sure, the Chinese economy is also hitting a bump this year as export demand evaporates in response to the global economic slowdown. Sagging asset values are another cause of concern, with the local stock market down about 70 percent this year, one of the worst performers in the world. Beijing recently unveiled another round of stimulus measures including increasing money supply by 17 percent to boost lending and consumption. It comes on the heels of a 4 trillion yuan package announced last month amid fears growth could fall below the 8 percent considered necessary to create enough jobs. Indeed, so many sea turtles (hai gui in Mandarin) have returned home that the people of Beijing, Shanghai and elsewhere have invented a new name for those returnees who cannot find a job: "seaweed" (hai dai). But, while unemployment is rising in China, there are still opportunities at the top of the labor market, especially for those with foreign education and experience. Zack Liu, who returned to China in earlier 2008 after more than a decade on Wall Street, says he was impressed by the efforts made by Chinese fund firms to institutionalize and professionalize the industry. Liu started his career in finance in 1996 at Bear Stearns after earning an MBA from Cornell and a PhD degree in physics from Florida State University. Over the past year, he has watched two of the three firms he worked for either collapse or merge with others as a result of the credit crunch. "It's sad to watch all these big banks fail. Life is like a roller-coaster. I made the right decision at the right time to come back to China," Liu tells reporters by phone from his new home in Shenzhen. Patriotism is sometimes a factor, but economic interest is certainly a much more important consideration. Still, many "sea turtles" acknowledged that they're willing to accept lower pay if the job provides attractive career prospects. Career International, a leading recruitment firm in Beijing, says there has been a jump in interest from Chinese employees on Wall Street. Their potential employers in China, according to the company, mostly offer a base pay in the range of $100,000 to $500,000. "Before the crisis, we were receiving about five resumes per week on average. Now, it's two or three times of that," Jun Xu, director of the firm's financial services group, says by telephone from Beijing. "We're also trying to help their families through the transition. Unlike us (who only have one child), many 'sea turtles' have two or three kids and some also need a bilingual daycare center." Some in the United States, such as Ke Zhang, who works for a hedge fund after being laid off from Lehman Brothers earlier this year, are taking a wait-and-see attitude. "The economy here is terrible," says the 27-year-old who holds a masters degree from Columbia University. "Gaining experience in the US is still very important. Besides, the employment situation in China is far from rosy either." (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 竹山县| 金平| 新龙县| 纳雍县| 平罗县| 阳朔县| 新乡市| 乌苏市| 炉霍县| 洮南市| 吉木乃县| 潜江市| 资阳市| 沐川县| 松原市| 和顺县| 日土县| 襄樊市| 搜索| 阳山县| 元谋县| 鸡东县| 屏南县| 定结县| 论坛| 禄丰县| 淮南市| 白水县| 新兴县| 澄江县| 清徐县| 沧州市| 诏安县| 横峰县| 咸宁市| 宝丰县| 祥云县| 巫山县| 鸡东县| 四会市| 左贡县| 顺义区| 陆河县| 彭州市| 阿克陶县| 平凉市| 瑞安市| 涞源县| 崇明县| 新营市| 突泉县| 林芝县| 卓尼县| 河南省| 土默特右旗| 闸北区| 台湾省| 惠来县| 青铜峡市| 大荔县| 南投县| 阿图什市| 天镇县| 连州市| 六盘水市| 宜城市| 廉江市| 翁源县| 滨海县| 衡阳县| 阜平县| 临夏市| 岳阳市| 武义县| 靖边县| 东海县| 潮州市| 三河市| 嘉义县| 天镇县| 根河市| 通江县|