|

BIZCHINA> Top Biz News

|

|

Choppy winds ahead for COSCO

By Tong Hao (China Daily)

Updated: 2009-01-13 07:43

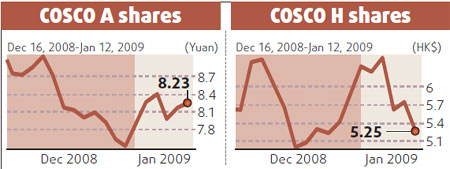

Falling business and a gross misjudgment of freight rate movements have dealt a double blow to China's COSCO Holdings (COSCO), threatening to plunge the world's largest dry bulk carrier deep into the red. The company's outlook for 2009 seems bleak as the global shipping industry is expected to remain in the doldrums for most of the year, if not longer. Shortly after COSCO announced a surge in profit for third-quarter 2008, it posted a chilling statement on Dec 16 on the Shanghai and Hong Kong bourses disclosing a 3.95 billion yuan potential loss arising from "misjudgment" in Forward Freight Agreements (FFA). In the disclosure, the company conceded that the situation was "serious", setting off a wave of selling of its shares. COSCO shares decreased by 5.5 percent from 8.78 yuan on Dec 16 to 8.23 yuan on Jan 12 in the Shanghai Stock Exchange, while falling by 6.4 percent from HK$5.61 to HK$5.25 in Hong Kong trading.

Analysts said that as the BDI continues to fall, potential losses of the company in FFA contracts will grow larger than previously expected. CITIC Securities Co Ltd estimated that COSCO's fourth-quarter loss could reach 5 billion yuan, in contrast to a 5.5 billion yuan profit for the previous three months. "The shipping industry slump will last for at least one or two years," predicted Qian Hongwei, analyst of China Securities Research Co Ltd, "The fortune of the shipping industry is tied to the recovery of the global economy, which can be a long time away." To conserve cash in these trying times, COSCO has reportedly canceled some shipbuilding orders and requested a delivery delay for others. Those moves have affected orders for 126 vessels. The company notified the Hong Kong stock exchange on Dec 22 that it was seeking to raise up to 10 billion yuan of new capital by a bond issue to help fund projected expenditure in fixed asset investment, fuel, labor and debt servicing. The company's latest financial report showed that it had 10.8 billion yuan in cash at the end of September. COSCO said it will try to maintain "sound and healthy financial status" by cost control and investment compression. It also has planned to reduce container shipping capacity to Europe and the US and explore potential new markets in Asia. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 得荣县| 赞皇县| 肇东市| 惠安县| 湘西| 鄂尔多斯市| 怀宁县| 沅陵县| 苍溪县| 涟源市| 当涂县| 额尔古纳市| 定远县| 遵义县| 耿马| 景泰县| 于都县| 灵寿县| 和林格尔县| 休宁县| 河津市| 苗栗市| 太保市| 紫金县| 进贤县| 延长县| 海盐县| 成安县| 松阳县| 安康市| 太白县| 湘乡市| 綦江县| 博白县| 夏河县| 十堰市| 墨脱县| 嫩江县| 香港 | 丹寨县| 济阳县| 纳雍县| 龙陵县| 房山区| 望江县| 中牟县| 阿合奇县| 手机| 左权县| 尼勒克县| 马鞍山市| 化德县| 左贡县| 当雄县| 卓资县| 红安县| 襄垣县| 阿拉善左旗| 故城县| 山东| 新密市| 彭山县| 锦屏县| 金堂县| 荔浦县| 仁寿县| 遵义市| 咸宁市| 乌鲁木齐县| 峨山| 河源市| 临高县| 祁连县| 湘西| 和龙市| 盈江县| 清苑县| 连城县| 尚义县| 开江县| 西乡县| 启东市|