|

BIZCHINA> Top Biz News

|

|

Sanyuan gears up for Sanlu assets

By Ding Qingfen (China Daily)

Updated: 2009-03-03 08:06

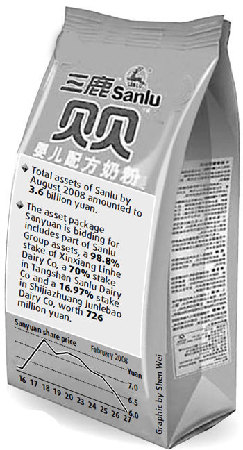

Beijing Sanyuan Food Co Ltd is fully prepared to take over the assets of the company at the center of last year's melamine scandal, and expects that about 30 percent of Sanlu's sales will be recovered this year, according to Sanyuan executives.

But analysts are still worried about the prospects of the transaction, saying the deal is not that appealing given the high price Sanyuan had to pay and the ongoing sluggish dairy market, as well as doubts as to whether Sanyuan will be capable enough to manage Sanlu's assets. At its first corporate shareholder meeting of 2009 yesterday, Sanyuan submitted its plan on bidding for assets of Shijiazhuang-based Sanlu, which was declared bankrupt on Feb 12, through non-public share sale worth 800 million to 1 billion yuan. The company's two major shareholders are Beijing Sanyuan Group Co Ltd (Sanyuan Group) and Beijing Enterprises (Dairy) Ltd, which hold equity of 13.31 and 41.85 percent, respectively. This afternoon, Sanyuan will go through bidding-related procedures and hand in a cash deposit worth 200 million yuan to the commercial bank appointed by Sanlu. Tomorrow, bidding for the assets of Sanlu will be auctioned in the Intermediate People's Court of Shijiazhuang. Before the melamine scandal, Sanlu had been the top milk powder producer in China for 15 years, and Sanyuan, a famous liquid milk brand especially in Beijing and Hebei province, is expected to become a national brand and expand its production line by leveraging the Sanlu acquisition deal. When the deal is finalized, Sanyuan's milk powder business will target the mid- and high-end market. Reports about Sanyuan's plan to acquire Sanlu have been rampant since the tainted milk powder scandal. Sanyuan has suspended its shares since Sep 26 for discussing the detailed plan for the acquisition, and the company began renting and operating six major factories of Sanlu in late December 2008. Sanyuan's share resumed trading on Feb 16, after it announced it was raising funds by share sale, and the share price soared to the 10 percent daily limit for three straight days. Despite the share performance, analysts do not think highly of the deal, as the dairy market is sluggish and the competition is fierce. "Our rating about the deal remains neutral. We don't think Sanyuan could gain a sharp competitiveness soon as expected," said Guo Shengchang, senior dairy analyst from Shanghai Securities. The melamine scandal has badly hurt China's dairy industry. According to statistics, from September-November 2008, sales revenue from the sector dropped by 10 percent year-on-year and the dairy companies, for the first time, witnessed negative profits, compared with the average growth rate of 27 percent in revenues and 5.3 percent in profit ratio from January to August in 2008. And reports said many local consumers are not confident in the industry. The milk powder industry is highly competitive, with international brands holding the high-end market, and the local brands, the mid- and low-end sector. Sanyuan's shares got suspended yesterday for the shareholder meeting. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 开阳县| 伊吾县| 伽师县| 定襄县| 姜堰市| 广州市| 克拉玛依市| 广东省| 上饶县| 铁力市| 门头沟区| 衡东县| 永州市| 贡嘎县| 鹤庆县| 会宁县| 山阳县| 公主岭市| 乐清市| 闽侯县| 扬州市| 工布江达县| 绥德县| 临武县| 定安县| 永康市| 进贤县| 怀来县| 克山县| 昆山市| 桐城市| 台湾省| 民乐县| 海南省| 山东省| 视频| 德钦县| 大邑县| 开化县| 琼结县| 连平县| 宁海县| 乐都县| 阿城市| 柳州市| 蓝山县| 青神县| 融水| 荆州市| 宜兰县| 长宁区| 永康市| 清苑县| 晴隆县| 河南省| 绥中县| 宜都市| 铜陵市| 嘉禾县| 吉隆县| 博湖县| 大兴区| 黑山县| 石台县| 潼关县| 新宾| 仪征市| 石狮市| 德钦县| 柳江县| 新巴尔虎左旗| 金阳县| 虎林市| 凤阳县| 新龙县| 独山县| 云龙县| 谢通门县| 扎鲁特旗| 枣强县| 西乡县| 衢州市|