|

BIZCHINA> Top Biz News

|

|

Venture firms develop cold feet on crisis woes

By Bi Xiaoning (China Daily)

Updated: 2009-03-06 07:54

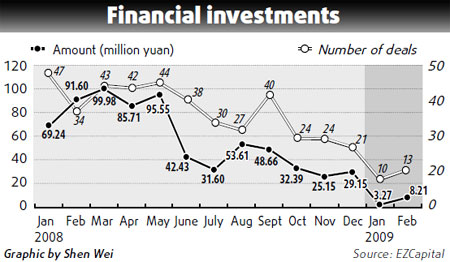

Investments by venture capital (VC) and private equity (PE) funds declined by 99 percent year-on-year in the first two months of this year, a report by the Beijing-based consulting firm Eternal Zenith Capital has revealed.

However, strategic investment in Chinese companies bucked the trend. During the first two months of this year, 14 Chinese companies got 14.87 billion yuan in strategic investment, up 22 percent year-on-year, the report pointed out. "Actually, strategic investment began to increase from end of last year, as industry heavyweights, which seek long-term development, were less affected by the economic cycle," Eternal Zenith Capital's analyst Hua Jing said. The report also noted that mergers and acquisition (M&A) activity flourished in the first two months of the year. There were 46 M&A transactions totaling 35.8 billion yuan during the first two months, a four-fold increase over the same period last year, it said. The first quarter is usually a quiet season for investment activity as companies take a break from capital raising. Only four investment institutions have set up new funds in January, raising about 7.02 billion yuan, the report showed. The IPO market has remained sluggish since September of last year. In the first two months of this year, only eight companies went public, raising a combined 1.78 billion yuan. Among these companies, one was listed on the A-share market, five went public in Hong Kong and two in New York. The report also revealed that mezzanine capital funds, which provide interim investment to companies, got more opportunities to invest this year as companies found it hard to raise capital through initial public offerings or debt.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 美姑县| 湘阴县| 青川县| 水富县| 集安市| 嫩江县| 湘潭市| 怀柔区| 潮安县| 赤壁市| 即墨市| 承德县| 肥乡县| 文山县| 郎溪县| 新源县| 阜南县| 萍乡市| 乐安县| 化德县| 库尔勒市| 积石山| 介休市| 永和县| 西林县| 舒兰市| 体育| 福安市| 武强县| 咸宁市| 仪陇县| 运城市| 睢宁县| 巴东县| 瓮安县| 临泉县| 神农架林区| 合水县| 新疆| 西吉县| 鄂尔多斯市| 太原市| 安西县| 兴安盟| 浠水县| 拜泉县| 陆丰市| 阿鲁科尔沁旗| 金川县| 焦作市| 社会| 望谟县| 来安县| 鸡西市| 庆安县| 屏东县| 新干县| 环江| 荥阳市| 灵山县| 永济市| 鲁山县| 大姚县| 英吉沙县| 宜昌市| 泌阳县| 蓬溪县| 天水市| 通州区| 南投县| 京山县| 易门县| 磐安县| 兰西县| 抚宁县| 内乡县| 西贡区| 洮南市| 百色市| 太白县| 旌德县| 大宁县|