|

BIZCHINA> InfoGraphic

|

|

Venture firms develop cold feet on crisis woes

By Bi Xiaoning (China Daily)

Updated: 2009-03-06 07:54

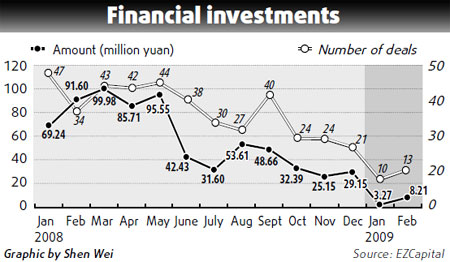

Investments by venture capital (VC) and private equity (PE) funds declined by 99 percent year-on-year in the first two months of this year, a report by the Beijing-based consulting firm Eternal Zenith Capital has revealed.

However, strategic investment in Chinese companies bucked the trend. During the first two months of this year, 14 Chinese companies got 14.87 billion yuan in strategic investment, up 22 percent year-on-year, the report pointed out. "Actually, strategic investment began to increase from end of last year, as industry heavyweights, which seek long-term development, were less affected by the economic cycle," Eternal Zenith Capital's analyst Hua Jing said. The report also noted that mergers and acquisition (M&A) activity flourished in the first two months of the year. There were 46 M&A transactions totaling 35.8 billion yuan during the first two months, a four-fold increase over the same period last year, it said. The first quarter is usually a quiet season for investment activity as companies take a break from capital raising. Only four investment institutions have set up new funds in January, raising about 7.02 billion yuan, the report showed. The IPO market has remained sluggish since September of last year. In the first two months of this year, only eight companies went public, raising a combined 1.78 billion yuan. Among these companies, one was listed on the A-share market, five went public in Hong Kong and two in New York. The report also revealed that mezzanine capital funds, which provide interim investment to companies, got more opportunities to invest this year as companies found it hard to raise capital through initial public offerings or debt.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 卢龙县| 松阳县| 宣汉县| 堆龙德庆县| 宁明县| 漾濞| 隆尧县| 内黄县| 宁陕县| 凉山| 贺州市| 荔浦县| 酉阳| 玉屏| 济南市| 大港区| 乃东县| 麟游县| 金沙县| 中超| 洪泽县| 西乌珠穆沁旗| 景泰县| 班玛县| 铁岭市| 朝阳县| 田林县| 永康市| 衡阳县| 长顺县| 阜阳市| 三江| 泾阳县| 泰安市| 屯留县| 石首市| 吉木乃县| 疏附县| 黑龙江省| 张掖市| 乌苏市| 宜章县| 斗六市| 怀化市| 奉贤区| 福泉市| 承德市| 崇信县| 吴桥县| 大竹县| 阳高县| 兴国县| 天水市| 博客| 泸西县| 苍梧县| 西华县| 穆棱市| 运城市| 闻喜县| 岳池县| 绥滨县| 甘谷县| 登封市| 盐池县| 香格里拉县| 博兴县| 溧阳市| 马山县| 华宁县| 合川市| 伊宁市| 昌乐县| 隆回县| 昌平区| 榆树市| 镇雄县| 莒南县| 定南县| 海门市| 泊头市| 泰顺县|