|

BIZCHINA> Top Biz News

|

|

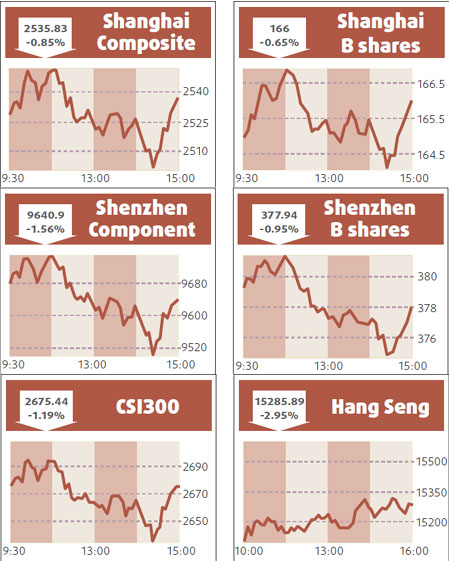

Stocks slip 0.85% on fresh crisis concerns

(China Daily)

Updated: 2009-04-22 08:01

The mainland stocks slipped 0.85 percent in active trade yesterday, knocked by a drop in financial, energy and metals shares as renewed concerns about the financial crisis weighed on stock and commodity prices overseas. The Shanghai Composite Index ended at 2535.828 points after hitting a low of 2499.601 points. It had climbed on Monday to an eight-month closing high. Turnover in Shanghai A shares rose to 154.6 billion yuan from Monday's 140.1 billion yuan. A jump in bad loans at Bank of America, the largest US bank, rekindled fears about the state of the banking sector globally and pushed prices of industrial commodities such as oil and copper sharply lower.

"Investors are jittery after the slump in overseas markets, but the index is not expected to fall too much and investors might be lured back to the market if overseas markets stabilize," said Huatai Securities analyst Zhou Lin. Frank Gong, chief China economist at JPMorgan Chase, said yesterday that the Shanghai index was likely to hit 2800 to 3000 points this year, with a bull market now in its beginning stage as the Chinese economy had bottomed out. Xiangcai Securities analyst Wu Nan added: "The correction today was smaller than expected. The index came off of its low, suggesting that sentiment is supported by investors' general confidence in China's economic recovery, but risks are growing as the index rallies." Banks were lower, with Industrial and Commercial Bank of China, China's biggest lender, off 0.96 percent at 4.12 yuan while Hua Xia Bank sank 4.37 percent to 10.5 yuan despite posting a 46 percent jump in earnings last year. Coal shares were weak, with Shenhua Energy losing 2.51 percent to 23.73 yuan. Yunnan Copper, China's third-largest copper producer, sagged 2.39 percent to 20.4 yuan after saying its production in the first quarter fell 34 percent from a year earlier. HSI down 3% Hong Kong shares marked their biggest drop in two weeks, falling 3 percent yesterday as HSBC slid on a surge in bad debts at Bank of America while China Mobile succumbed to selling pressure after its first quarter earnings. The benchmark Hang Seng Index ended down 465.02 points at 15285.89. Shares worth HK$57.5 billion had changed hands compared with Monday's HK$57.1 billion. The China Enterprises Index of top mainland companies was 2.1 percent lower at 9039.09. Reuters

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 长阳| 兴宁市| 阿尔山市| 会昌县| 绥中县| 章丘市| 城固县| 礼泉县| 平罗县| 富宁县| 蕉岭县| 建平县| 淳安县| 旬阳县| 永安市| 施甸县| 合水县| 仁布县| 新巴尔虎右旗| 龙泉市| 南乐县| 如皋市| 遂溪县| 乐平市| 郓城县| 都昌县| 蒙自县| 临颍县| 云林县| 庐江县| 霞浦县| 望江县| 黑水县| 泽库县| 肇源县| 佛学| 石嘴山市| 舟山市| 开原市| 库尔勒市| 湘西| 福安市| 桐梓县| 塔河县| 桂东县| 松原市| 元阳县| 甘南县| 乐陵市| 左贡县| 沙河市| 中西区| 故城县| 息烽县| 白朗县| 德兴市| 巢湖市| 明星| 鸡东县| 汉沽区| 游戏| 顺义区| 涿鹿县| 建昌县| 蓝山县| 晋宁县| 玉树县| 凤翔县| 和田市| 温宿县| 双峰县| 衡东县| 佛坪县| 商城县| 凤台县| 班玛县| 时尚| 香港 | 雷波县| 陵川县| 昌图县| 中超|