|

BIZCHINA> Top Biz News

|

|

Growth enterprise board may significantly boost VC market

By Bi Xiaoning (China Daily)

Updated: 2009-04-27 08:02  Chinese authorities recently called for speeding up the establishment of the NASDAQ-like growth enterprise board (GEB), an idea that has been talked about for almost 10 years. "A GEB not only opens a new financing channel for the country's many small- and medium-sized enterprises (SMEs) but also offers a convenient exit channel for venture capitalists," said Shen Nanpeng, founder and partner of Sequoia Capital China, a three-year-old unit of US-based Sequoia Capital. Limited exit channels have always troubled foreign and domestic venture capitalists keen on tapping China's fast charging economy. When times were good, as they were for much of the past decade, the issue wasn't much of a concern because overseas listings, in Hong Kong or on the NASDAQ, were not only possible but also welcomed by global investors.

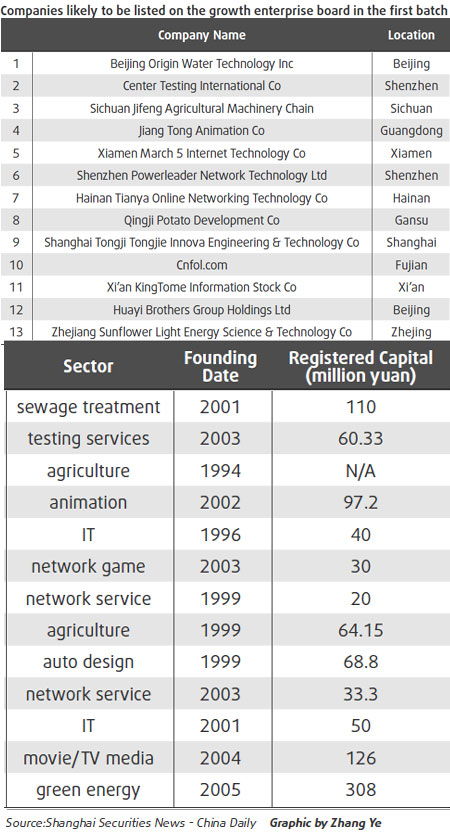

"The GEM gives us great hope. The country's VC companies can develop more rapidly in a multi-level capital market," said Jin Haitao, chairman of Shenzhen Capital Group Co Ltd, a Chinese VC firm founded in 1999. China's securities regulator released guidelines on March 31 to establish the long-awaited GEB. The preparation work, which includes drafting specific transaction regulations and educating professional agencies and investors, may take several months. Companies with potential to get listed on the GEB became favorites for VC companies. "A NASDAQ-like market in China is important to us because selling shares directly to the public usually yields higher investment returns than merger and acquisitions (M&A) or other exit channels," said Ye Guantai, general manger at Highland Capital Partners, a joint venture backed by a US fund. Specific regulations on the lockup period haven't been released yet. "The to-be launched GEB could help VC firms to shape a smooth cycle of investment, value-added increment, exit and new investment, which could dramatically boost the VC market," said Gongmeng Chen, director of the China Venture Capital Research Institute. There were over 400 VC firms registered in China by the end of February. According to market researcher Zero2IPO, VC firms have played an active role in China's capital market, which invested about $15 billion in 3,176 projects in China from 1999 to 2008. Over the past 10 years, about 191 venture capital-backed Chinese companies were listed domestically or overseas, with a combined market value of over $80 billion. Industry analysts said a considerable capital supply and abundant company resources are critical to launch the GEB in China. "Innovative Chinese companies can expect ample capital support from the VC companies, which have about $25 billion of capital on hand now, including $16 billion from foreign VC companies," said Zero2IPO CEO Ni Zhengdong. According to the Shenzhen Stock Exchange, the bourse for the GEB, over 300 companies from 29 economic development zones over the country are preparing to list on the GEB. "Currently we have equity rights in 148 companies, 60 of which meet the basic requirements of the GEB, especially for high growth rates and innovation," said Li Wanshou, president of the Shenzhen Capital Group. According to Li, the innovative companies engaged in green energy, communication equipments, modern agriculture and pharmaceutical healthcare are some of the most attractive for VC firms. Domestic VC firms may be actively preparing for the GEB but foreign VC companies are still waiting, since current regulations limit listing to domestic companies. "Foreign funds are also in need of exit channel. But there is no clear regulation allowing joint venture firms to get listed on the GEB," said Xu Chen, a partner of Gobi Partner, a joint venture back by an US fund. We are waiting for detailed rules. But the venture capital market in China may be about to take off," Xu added.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 突泉县| 简阳市| 南汇区| 怀柔区| 丰县| 普兰县| 嘉鱼县| 贡觉县| 鹤壁市| 岳普湖县| 武宁县| 米脂县| 曲沃县| 金门县| 罗源县| 正阳县| 平乐县| 深水埗区| 海盐县| 林州市| 临安市| 富川| 平顶山市| 新河县| 会东县| 彰武县| 龙门县| 垣曲县| 衡南县| 台湾省| 金溪县| 诸城市| 明水县| 襄樊市| 中西区| 天镇县| 漠河县| 突泉县| 渭源县| 当阳市| 抚顺市| 西藏| 界首市| 清涧县| 宁安市| 长汀县| 邓州市| 乌兰县| 紫阳县| 平罗县| 安龙县| 白水县| 南溪县| 余江县| 铜山县| 贞丰县| 南宁市| 石泉县| 思茅市| 南城县| 札达县| 柏乡县| 肇源县| 邛崃市| 皮山县| 双辽市| 大宁县| 浦北县| 资溪县| 龙门县| 含山县| 瑞金市| 沾益县| 天等县| 镇平县| 永昌县| 永安市| 仙桃市| 庄河市| 漳州市| 西峡县| 南丰县|