|

BIZCHINA> Top Biz News

|

|

VC deals showing renewed signs of life

By Bi Xiaoning (China Daily)

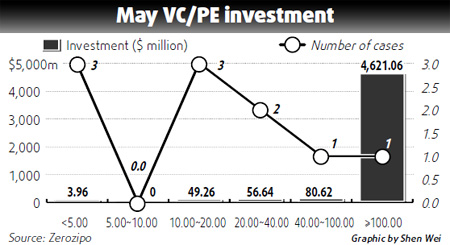

Updated: 2009-06-15 08:07  Venture capital and private equity firms have begun to find some new thirst for investment on the mainland after several months of inactivity, the market researcher Zero2ipo said in a recent report. Twenty-six venture capital (VC) and private equity (PE) companies invested $4.81 billion in 15 deals in May after a cautious April that registered only $156 million in total investment, the report said. The financial services industry attracted by far the most investment in May, some $4.64 billion, or fully 97 percent, of the total. It was one big deal in the finance sector that dramatically changed the investment mix toward financials. On May 12, PE funds led by Hopu Investment Management invested about $4.62 billion to buy 8.53 billion H shares of China Construction Bank. Traditional industries had been the recipient of the most investment in the first four months, yet only $100 million in new capital was directed to the sector in May.

According to Zero2ipo, three Chinese companies were listed in May with a combined capital of $1.35 billion, up 431.7 percent from April. All were manufacturing companies that raised an average of $449 million. HK-listed Liaoning Zhongwang Group Co, the country's largest aluminum extrusion products manufacturer and the third-largest in the world, raised about $1.3 billion on the main board in Hong Kong, the most among Chinese companies listed in Hong Kong since April of 2008. It was also the world's largest IPO since the beginning of the year. The other two Chinese companies were listed on the Korea Stock Exchange and Korea Securities Dealers Association Quotations, South Korea's counterpart to the NASDAQ. Six Chinese companies have now been listed in South Korea since August of 2007. While new capital rose, merger and acquisition (M&A) activities shrank in May, the report said. The number of M&A deals dropped 27.8 percent from a month earlier to 13 with a total value of $516 million, down 76.4 percent from April. Three M&A deals backed by VC and PE totaled $107 in the IT, traditional and healthcare industries. M&A deals in traditional industries, including manufacturing, energy, real estate and agriculture, comprised about 82 percent of M&A total in May. There were three cross-border M&A deals in May, two in mining in which Jilin Jien Nickel Industry Co invested $3.79 million to acquire Australia's Metallica Minerals Ltd and $40.38 million for Canada's Liberty Mines Inc. Due to the sustained impact from the global financial crisis, total capital raised by VC and PE funds to invest on the Chinese mainland had been in a free fall since the beginning of 2009. According to Zero2ipo, the total investment by VC companies dropped 71.2 percent year-on-year to $320 million in the first quarter, while the investment from PE funds declined 82.5 percent year-on-year to $2,687 million. Zerio2ipo showed in another report that a number of renminbi PE funds, represented by a green energy technology fund and an army civilian industrial fund, are preparing to raise capital. The number of industrial and equity investment funds that have been approved or recorded by the National Development and Reform Commission has reached 20, which together plan to raise 200 billion yuan. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 梁河县| 纳雍县| 长子县| 禹州市| 红安县| 叙永县| 兰溪市| 道真| 宝兴县| 钟祥市| 东丰县| 无极县| 太保市| 广东省| 会昌县| 中超| 亳州市| 定结县| 奎屯市| 土默特左旗| 望奎县| 镇赉县| 兴城市| 开原市| 和龙市| 汉寿县| 辉县市| 平潭县| 静乐县| 彭水| 潜江市| 柳江县| 秦皇岛市| 巴青县| 长岭县| 山东省| 三亚市| 财经| 砚山县| 元阳县| 荔浦县| 吐鲁番市| 西青区| 读书| 砀山县| 兴义市| 锡林浩特市| 土默特右旗| 新河县| 浏阳市| 军事| 英吉沙县| 张家界市| 延津县| 青田县| 石城县| 赣榆县| 化隆| 鹤山市| 磴口县| 天峻县| 衡山县| 元江| 赤峰市| 勃利县| 柘城县| 泸西县| 木里| 宕昌县| 黄骅市| 平乡县| 玉龙| 运城市| 定日县| 天台县| 辽宁省| 英山县| 鸡西市| 临猗县| 安国市| 长海县| 凭祥市|