|

BIZCHINA> Top Biz News

|

|

Brokers timid on next bull run

By Zhou Yan (China Daily)

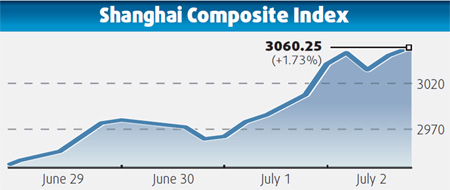

Updated: 2009-07-03 08:06  Although the Chinese stock market has breached the 3,000-point barrier after a six-month bull run, analysts and investors are cautious since they see the rally as being led largely by big-cap stocks rather than an across-the-board upswing. For instance, the benchmark Shanghai Composite Index rose a further 1.73 percent, or 52.1 points, to close at 3060.25 yesterday, driven by large caps, including Zijin Mining Group Co and PetroChina Co. More than 30 percent of the 863 stocks on the index, however, actually declined. This point hasn't gone unnoticed by 61-year-old veteran investor Jin Guigen. Sitting in the public gallery of a local stockbrokerage in downtown Shanghai, Jin said he kept reminding himself not to get too carried away by the new high set. Chatting with fellow investors in the hall, Jin recalled that when the market broke through the 3,000-point barrier during the bull run in 2007, nearly all shares were on the rise.

To be sure, not everyone is as cagey as Jin. Anticipating a rush by new investors into the market after the IPO ban was lifted recently, China Everbright Bank set up a stand last month in the stockbrokerage's public gallery to help investors open new accounts. Wang Yue, a manger at the bank, said the stand was seeing a rush in the past two days. "We have processed more than 90 new investment accounts since the stand was set up for business," Wang said. "There have been many more enquiries from people who were keen to get into the action this time," he said. The Chinese stock market has topped the global performance chart with the benchmark index gaining 68 percent since the beginning of 2009. Professionals, who track the big-cap stocks, are more confident about the rally than individual investors. "We're optimistic about the equities market in the second half," Daniel Casali, an analyst from Merrill Lynch Research, said in a recent note. "Recovery will be slow, but policy and positioning remain supportive." Ample liquidity, stabilizing economic fundamentals, as well as the gradual turnaround in corporate earnings, will help propel the market further, said Jing Ulrich, JP Morgan chairperson for China Equities, forecasting that the major gauge would hit 3,200 by the end of the year. The major adjustment risk will be for small- and medium-sized caps, which have seen little driving force after initial high advancement, said Wu Feng, an analyst at TX Investment Consulting Co.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 广丰县| 黔西| 仙游县| 寿阳县| 吴忠市| 泸水县| 邮箱| 沾化县| 呼伦贝尔市| 花莲市| 鄱阳县| 内江市| 新疆| 四子王旗| 武夷山市| 长治市| 北安市| 类乌齐县| 台南市| 马公市| 炉霍县| 花垣县| 平潭县| 福贡县| 绍兴县| 兴海县| 巴马| 金坛市| 绥滨县| 寻乌县| 上蔡县| 元氏县| 抚宁县| 故城县| 静乐县| 天等县| 苍溪县| 嵊州市| 罗甸县| 织金县| 弋阳县| 佛山市| 钦州市| 鞍山市| 富川| 滕州市| 泸溪县| 洪洞县| 新野县| 昭通市| 万宁市| 沐川县| 万年县| 塔河县| 长治市| 饶平县| 涪陵区| 南宫市| 甘孜| 池州市| 东阳市| 靖西县| 深水埗区| 司法| 江城| 犍为县| 贞丰县| 中牟县| 芦山县| 正蓝旗| 惠州市| 梁河县| 岚皋县| 武隆县| 清水县| 关岭| 孙吴县| 鹤峰县| 济宁市| 绍兴县| 新化县| 封丘县|