|

BIZCHINA> Top Biz News

|

|

Mainland stocks headed for 'sizable correction'

(China Daily/Agencies)

Updated: 2009-07-09 08:00

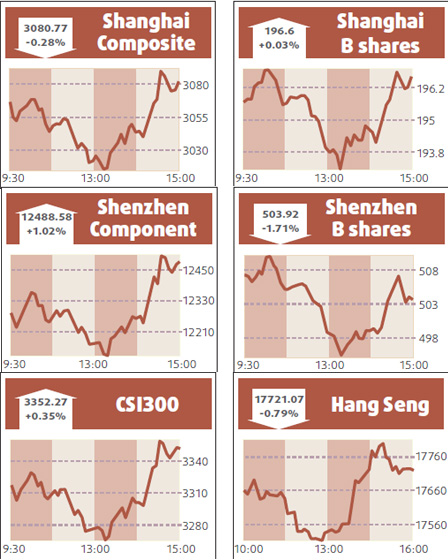

Mainland stocks may be headed for a "sizable correction" after a so-called momentum indicator for the Shanghai Composite Index advanced to the highest in at least five months. The 14-day relative strength index, or RSI, for the Shanghai Composite climbed to 83 this week, above the 70 threshold that signals to technical analysts an asset or market is poised to fall. The indicator compares the magnitude of recent gains to losses. The last time the Shanghai gauge's RSI breached the 80 level, in February, the stock measure sank as much as 13 percent in following two weeks. "The RSI shows that the market is in a pretty overbought situation," said Barole Shiu, a Hong Kong-based technical analyst at UOB-Kay Hian Ltd. "If history repeats itself, there is a very strong chance we'll see a sizable correction."

At the stock measure's peak in October 2007, its RSI reached 79.6, a level not seen again until this year. The Shanghai Composite plunged 72 percent in the following 12 months before rebounding, according to data tracked by Bloomberg. Shiu said the Shanghai A Share Index, the stock gauge he tracks, may fall at least 200 points, or 6 percent, before finding a support at around 3000. The measure, which tracks only yuan-denominated shares traded in Shanghai, yesterday closed at 3243.29. Its RSI climbed to 83.1 on July 6. "The Shanghai Composite moves in more or less a similar pattern to the Shanghai A Share Index," he said. Hang Seng declines Hong Kong stocks dropped, dragging the Hang Seng Index to a two-week low, as lower oil and metal prices dragged commodity stocks lower. Property and banking shares declined on concern the government will restrict lending for real estate investment. "We've seen a massive rally with very little correction. People got carried away and are just beginning to be a little bit realistic," said Khiem Do, head of multi-asset strategy at Baring Asset Management (Asia) Ltd. The Hang Seng Index lost 0.8 percent to 17721.07 at the close. The Hang Seng China Enterprises Index dropped 1 percent to 10573.71.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 靖江市| 旌德县| 台北县| 杭锦旗| 兴宁市| 通海县| 巩留县| 井研县| 岳阳市| 广水市| 凌源市| 黄骅市| 施甸县| 宝坻区| 白朗县| 青冈县| 呼图壁县| 建平县| 南宁市| 沾益县| 信阳市| 马山县| 澄江县| 宝鸡市| 大姚县| 淮阳县| 辰溪县| 桂东县| 西华县| 阿城市| 吐鲁番市| 紫阳县| 丽水市| 延川县| 新河县| 黎川县| 康定县| 屯门区| 九台市| 饶平县| 北川| 汽车| 达州市| 黄龙县| 昌图县| 岳西县| 德兴市| 黄浦区| 青冈县| 瓮安县| 河源市| 凤城市| 石河子市| 伊川县| 右玉县| 福泉市| 哈巴河县| 禹州市| 巴楚县| 伊金霍洛旗| 苏州市| 新兴县| 富民县| 贵德县| 金堂县| 民乐县| 遂宁市| 临清市| 牡丹江市| 衡水市| 郁南县| 赤壁市| 呼和浩特市| 阳高县| 邻水| 白银市| 三明市| 昭觉县| 泸水县| 葫芦岛市| 缙云县| 菏泽市|