|

BIZCHINA> Top Biz News

|

|

Liquidity crunch, loan limits stop market rally

By Zhou Yan (China Daily)

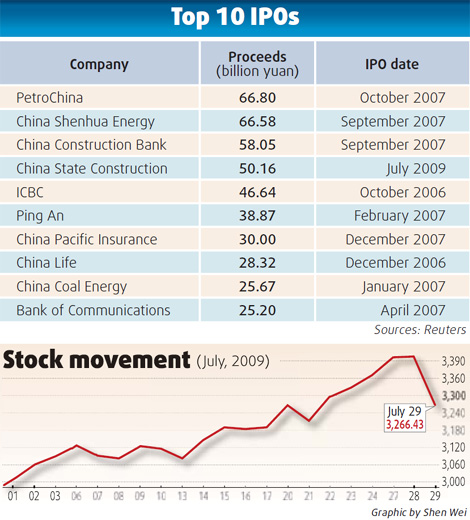

Updated: 2009-07-30 08:00 Chinese stocks plunged 5 percent yesterday, the biggest one-day drop in eight months, on the back of capital diversion from the mega debut of China State Construction Engineering Corp (China Construction) in Shanghai and concerns over bank lending restrictions. The benchmark Shanghai Composite Index sank 171.94 points to 3,266.43 points. It dropped as much as 7.7 percent in the afternoon session. The smaller Shenzhen Component Index lost 5.54 percent to 13,070.6 points.  Investors' selling spree pushed the combined turnover on the two bourses to a historical new high of 437.3 billion yuan. "The persistent rally over the last five months made the market value irrational, so a correction was necessary," said Zhong Hua, a strategic analyst with Changjiang Securities. Shares of China Construction, the country's largest home builder, added 56.22 percent on the first trading day yesterday to close at 6.53 yuan, below the opening price of 6.70 yuan, with about 70 percent shares changing hands. The builder of the Olympic aquatics center "Water Cube" raised 50.2 billion yuan in new capital in its stock offering last week at 4.18 yuan apiece, making it the biggest IPO in the world since March 2008.

Investors' penchant for newly-listed stocks was also cooled down by the bad performance of Sichuan Expressway in the last two days after a remarkable surge of over 300 percent at its Shanghai debut on Monday, Mao added. A-shares of the toll-road operator dropped straight to its daily caps of 10 percent in the following two days. The China Securities Regulatory Commission lifted a nine-month ban on new listings in June after seeing the turnaround of the stock market, which doubled from last year's low in November to become the world's best performer early this week. "Unlike smaller caps such as Sichuan Expressway that were mainly propped up by hot money and individual investors, heavyweights like China Construction are mostly influenced by more rational fund managers," said Mao, adding that institutional investors' judgment was largely based on valuation, which prevented China Construction from surging out of reasonable levels. Nonetheless, China Construction's closing price of 6.53 yuan, which equals to 43 times its price/earnings (P/E) ratio, was still over-valued, in comparison with the average valuation in the real estate and construction sectors, according to Qiu Bo, an analyst at Guosen Securities. According to financial information provider Wind Info, the average P/E ratio in the construction sector was 27.9 times. "The rational price range of the company should be around 4.8 yuan to 6.2 yuan," said Qiu, projecting the construction giant's earnings per share in 2009 to reach 0.17 yuan. In yesterday's trading, losing stocks outnumbered advancing ones by 1607 to 98, mainly pulled down by shares in the construction and property sectors with only 5 out of 105 trading stocks gaining. Vanke Real Estate Co, the country's largest property developer, shed 7.3 percent to 13.2 yuan, while rival Poly Real Estate Group Co dropped 8.6 percent. "The still ample liquidity will limit the market decline going forward, but the growth range will largely depend on the property transactions and the second-quarter earnings results from the realty developers under uncertain property policies," Changjiang Securities' Zhong said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 通化市| 汶川县| 丹江口市| 东乌珠穆沁旗| 蚌埠市| 天柱县| 石柱| 合水县| 武宁县| 商南县| 威海市| 亚东县| 自贡市| 昌吉市| 万载县| 台南市| 竹溪县| 安塞县| 安达市| 湟中县| 始兴县| 大洼县| 门源| 广西| 聂拉木县| 衡水市| 宜春市| 囊谦县| 清徐县| 长沙县| 治县。| 称多县| 当雄县| 汉源县| 北流市| 永济市| 中卫市| 成武县| 都兰县| 绥德县| 前郭尔| 灵山县| 仲巴县| 商都县| 东乡县| 虎林市| 天等县| 额敏县| 甘南县| 满城县| 忻州市| 房产| 丰都县| 广饶县| 同心县| 长丰县| 游戏| 义马市| 顺昌县| 肇庆市| 瓦房店市| 新津县| 海原县| 交口县| 北票市| 喀喇沁旗| 通河县| 德兴市| 图们市| 满城县| 西盟| 雷州市| 紫阳县| 苍南县| 行唐县| 信丰县| 浪卡子县| 鄂托克前旗| 四川省| 谷城县| 洛宁县| 平阳县|