|

BIZCHINA> Top Biz News

|

|

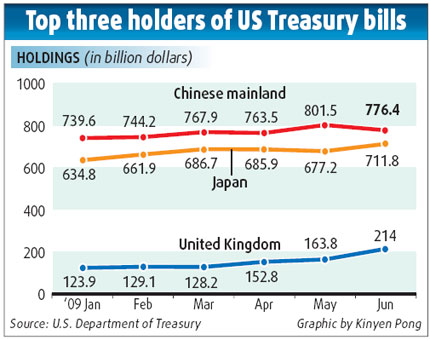

Cut in holdings of US debt may help diversify China's reserves

By Si Tingting (China Daily)

Updated: 2009-08-19 07:22

China drastically cut its holdings of US Treasury debt in June, but its purchase of more long-term securities indicates no significant change in its interest in US government bonds. The country's holding of US Treasury securities fell to $776.4 billion in June, from a record high of $801.5 billion in May. Despite the biggest monthly drop since 2000, China still retained its position as the top holder of US treasuries, according to US Treasury data released on Monday. While slashing its holdings of short-term bills by 25 percent, to $158.7 billion, China rotated into longer-dated maturities by $27 billion, a 4.5 percent increase.

"The fact that China has now returned and bought long-term notes is an encouraging sign," Patrick Bennett, Asia Foreign Exchange Rates Strategist with Societe Generale in Hong Kong, told China Daily. "It shows that China, as an investor, sees value in the issues and this speaks to the credibility of US policies." Bennett dismissed the idea that China's reduction in the holding of US treasuries represents "a big move". "The change is a slight surprise, but we need to see the next couple of months' data before determining the trend of purchases," he said.

"The recent pattern suggests China hastened its effort to diversify its international reserves," Crescenzi said. China's foreign exchange reserves totaled $2.13 trillion at the end of June. Yin Zhongli, a senior researcher with the financial research institution of the Chinese Academy of Social Sciences, believes that the share of US dollar-dominated assets in China's foreign exchange reserves is too large. "So, we have to diversify our portfolio for risk aversion," Yin said, adding that the country might buy more assets denominated in other foreign currencies, such as the euro, the Japanese yen and the Australian dollar. "But investment in US treasuries is still relatively safe compared with other options, because the recovery of the US economy is, by and large, stronger than other major economies, such as the European Union," he said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 双桥区| 镇江市| 犍为县| 忻州市| 镇雄县| 双鸭山市| 深圳市| 满城县| 祁连县| 梁河县| 扎鲁特旗| 涞源县| 河津市| 八宿县| 景洪市| 乐都县| 濮阳县| 大理市| 抚顺市| 西畴县| 神木县| 漳浦县| 永春县| 江口县| 咸阳市| 临高县| 株洲市| 将乐县| 应用必备| 弥勒县| 北碚区| 高碑店市| 铜梁县| 德州市| 石棉县| 东港市| 福鼎市| 潜江市| 水富县| 梅州市| 剑河县| 察哈| 太保市| 延边| 马鞍山市| 临城县| 阳江市| 滨海县| 清苑县| 怀集县| 苗栗县| 黄梅县| 尉氏县| 普安县| 囊谦县| 北京市| 唐山市| 丹阳市| 抚远县| 安塞县| 玛纳斯县| 淳化县| 兴文县| 甘南县| 那曲县| 金溪县| 拉萨市| 阿城市| 阳东县| 凤山县| 隆尧县| 滦南县| 固原市| 台南县| 舟曲县| 新河县| 彝良县| 延津县| 大渡口区| 迭部县| 邵武市| 太和县|