|

BIZCHINA> Top Biz News

|

|

Shanghai copper limit up, chasing LME gains

(China Daily/Agencies)

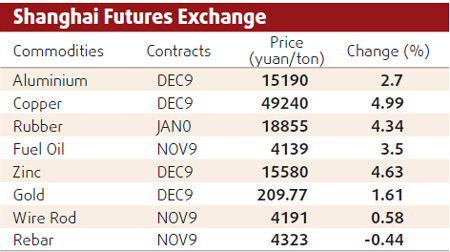

Updated: 2009-08-25 08:07 Shanghai copper rose by its 5 percent daily limit yesterday, chasing sharp gains in London fanned by Fed chief Ben Bernanke's comments on economic recovery. London Metal Exchange copper for delivery in three months rose almost seven percent since Shanghai closed on Friday, lifted by Bernanke, who gave his clearest signal yet that a recovery is at hand, while the biggest rise in sales of previously owned US homes in July in nearly two years added to the bullish sentiment. "Copper is a vampire metal - some weak data puts a stake through its heart, but a sniff of a positive number and it's back flapping its wings," a dealer in Singapore said. "I doubt anyone in the market thinks this price is a reflection of the state of demand and supply, and from the volatility it's fairly obvious the market is being played by speculators. We need to see whether their money is here for the long haul or just short-term punting." Benchmark third month Shanghai copper rose 2,340 yuan ($342.55) from Friday's settlement to 49,330 yuan, and zinc also hit its threshold at 15,530 yuan before retreating to 15,460 yuan at the close. Copper for three-month delivery on the LME jumped 1.9 percent to $6,386 in early trading, having closed up 3.7 percent on Friday. Copper earlier hit $6,410, its highest in just over a week.

"While we see this inconsistency in the macro economic news, prices are going to remain very volatile and I think this will last for a couple more months at least," the dealer said. The latest steer came from China, where refined copper imports fell 23 percent to 292,226 tons in July from June's 378,943 tons, ending five months of record inflows, data from the General Administration of Customs showed. Despite the fall, imports in the first seven months of the year were up almost 170 percent from the same period last year, at 2.07 million tons. "Merchants, end-users and speculators reduced spot imports as that had no margins," Zhu Yanzhong, analyst at Jinrui Futures, said. Analysts and traders had expected July's imports to fall by between 10 and 30 percent. Shanghai copper has tended to trade at a discount to London since early June. Yesterday, the benchmark contract in the eastern Chinese city was 1,700 yuan less than its LME equivalent, taking into account China's 17 percent Value Added Tax. Lead prices rose 3 percent to $1,920 after Henan, China's top refined lead producing province, said it had shut down up to 240,000 tons of annual lead smelting capacity in recent days following lead poisoning reported to have affected hundreds of children in Shaanxi province. Aluminum rose by $24.50 to $1,954.50, while nickel, which came a little late to the party on Friday, lagging copper's rise with a gain of 2.3 percent, surged as much as $749 or 3.9 percent to top out at $20,049. In early trading, prices ticked back to $19,900.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 桂林市| 汝南县| 东海县| 收藏| 普兰店市| 青川县| 丹棱县| 鄂州市| 定南县| 青龙| 漳州市| 清水河县| 师宗县| 马边| 鄂伦春自治旗| 临清市| 砚山县| 叶城县| 长治县| 开平市| 兰考县| 安顺市| 清原| 准格尔旗| 浦城县| 清水县| 鄂伦春自治旗| 武威市| 崇文区| 灵寿县| 扎赉特旗| 二连浩特市| 全州县| 阆中市| 池州市| 鹿邑县| 班玛县| 龙泉市| 崇文区| 毕节市| 蛟河市| 加查县| 沿河| 竹山县| 保康县| 巴林右旗| 枝江市| 穆棱市| 宁乡县| 商河县| 乳山市| 古丈县| 浦江县| 龙胜| 遂川县| 大名县| 嘉定区| 宕昌县| 岳西县| 彰化县| 平度市| 宜川县| 唐山市| 长垣县| 凯里市| 永胜县| 哈巴河县| 满洲里市| 桂平市| 金昌市| 固原市| 通榆县| 阜新| 石首市| 隆尧县| 中超| 桑植县| 安陆市| 博野县| 霍州市| 崇明县| 芜湖市|