|

BIZCHINA> Top Biz News

|

|

Stocks edge down as heavyweights plunge

(China Daily/Agencies)

Updated: 2009-08-28 08:13

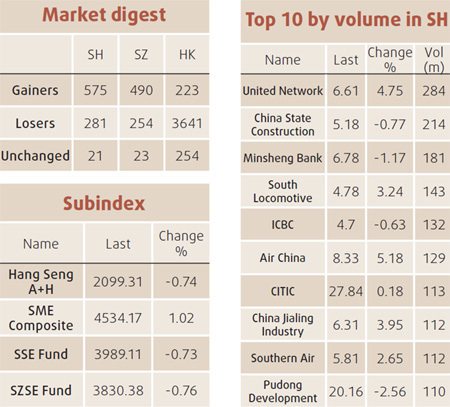

China's benchmark stock index fell, led by raw-material producers, after the government said it might curb overcapacity in industries including steel and cement. PetroChina Co, the world's most valuable company, slid 2.7 percent on concerns that industrial curbs will reduce the demand for energy. Aluminum Corp of China Ltd, the nation's largest producer, dropped 3 percent after it said Chinese smelters and trade warehouses hold as much as 600,000 metric tons of inventories because of surplus output. GD Midea Holding Co, China's second-biggest publicly traded appliance maker, climbed 6 percent after saying first-half profit rose. About two stocks rose for each that fell on the Shanghai Composite Index, which lost 0.7 percent to 2,946.40 at the close. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, slipped 0.5 percent to 3,156.30. The State Council said it is analyzing restrictions on industry overcapacity as policymakers seek to rein in investment growth fueled by credit expansion. "The market is afraid it's a sign of tightening, but in the long run the curbs will benefit listed companies as most of them are leaders in their industries," said Zhang Xiuqi, a Shanghai-based strategist at China International Fund Management Co, which oversees about $10.2 billion. The Shanghai Composite is down 14 percent this month, the world's worst performer, amid speculation the government will curb lending that rose to a record in the first half.

PetroChina dropped 2.7 percent to 14 yuan ($2.05). China Shenhua Energy Co, the nation's biggest coal producer, lost 3 percent to 32.37 yuan. The two stocks accounted for about 70 percent of the decline in the Shanghai index yesterday. Crude oil slipped 0.9 percent to $71.43 a barrel in New York on Wednesday, the lowest settlement since Aug 18. Aluminum Corp of China, also known as Chalco, declined 3 percent to 14.61 yuan. "This is tightening but it's not a total shutdown," said Ken Peng, an economist with Citigroup Inc. "Policy hasn't reversed but they are contemplating moves that have a lesser impact on the broader economy." Midea climbed 6 percent to 16.91 yuan after saying first-half net income rose 19 percent from a year earlier. Air China Ltd, the nation's largest international carrier, jumped 5.2 percent to 8.33 yuan, a second day of gains after saying first-half profit more than doubled.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 云阳县| 巫山县| 宁蒗| 甘孜| 高碑店市| 镇坪县| 句容市| 汝南县| 炎陵县| 长汀县| 扎赉特旗| 临西县| 繁昌县| 永安市| 东兰县| 贵阳市| 留坝县| 雷州市| 剑川县| 潍坊市| 松溪县| 牙克石市| 延边| 伽师县| 威宁| 伽师县| 海丰县| 连江县| 旬阳县| 抚远县| 仙游县| 义马市| 罗甸县| 桦南县| 罗山县| 白城市| 呼伦贝尔市| 天津市| 灵武市| 陇西县| 廉江市| 宁波市| 龙门县| 商南县| 河曲县| 锡林浩特市| 玉龙| 霍邱县| 苍山县| 新河县| 淳安县| 江西省| 铜梁县| 长海县| 玛曲县| 瑞丽市| 彰武县| 花垣县| 元氏县| 噶尔县| 汉沽区| 泗洪县| 呈贡县| 抚宁县| 宜阳县| 中阳县| 稻城县| 喜德县| 青龙| 奎屯市| 康马县| 孝感市| 蚌埠市| 陵水| 桐梓县| 洪江市| 隆尧县| 封丘县| 宣汉县| 泽库县| 永川市| 浦县|