Opinion

Investors should rely more on market trends than news

(China Daily)

Updated: 2009-12-01 08:02

|

|

Markets are driven by news but it is the way the news is incorporated into price activity that is important. Investors have a choice. They can follow the news and react to it depending on their own personal psychology. Or they can put the news into a wider context of the market's psychological behavior and then decide how they will respond.

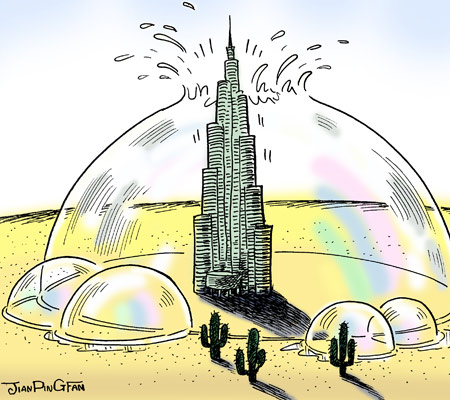

Investors using news can always make a case for the bear, or the bull. The bearish news this week came from Dubai. The Emirate of Dubai wants creditors of Dubai World and property group Nakheel to agree a debt standstill. This is the conglomerate that has led the rapid growth in the country. The announcement dragged European market indexes into their worst daily loss in seven months. The Japanese Nikkei also felt the effect and the announcement made US markets nervous.

More bearish news came with hot money flow. The State Administration of Foreign Exchange tightened settlement and sale of foreign exchange by individuals to curb non-normal cross-border capital inflow.

The bullish news last week came from the American markets. The Dow Index made new 13-month highs. This indicated a continuation of the long-term uptrend and hinted at an improving economy.

Investors who only follow the news are surrounded by contradictory stories and analysis. Investors who watch the behavior of the market have a method to resolve the contradictions. They watch the behavior of people in the market and use this as a guide to making better decisions. This is the most important advantage of chart analysis. It allows the investors to understand the psychological behavior of people who are prepared to back up their opinion when they buy or sell in the market. This is a more reliable guide to the market development than only following the news and relying on your personal feelings.

Several features are revealed when this type of analysis is applied to the Shanghai Index. The strongest pattern of index activity is a cup and handle pattern. This is an important trend reversal pattern. The cup pattern developed between August and October 2009. The handle pattern is a small retreat pattern. The breakout from this pattern develops a new uptrend. The depth of the cup pattern is measured and used to calculate the upside breakout target near 3400. This pattern confirms the bullish behavior of the market and the retreat last week.

Investors behave in consistent ways. These consistent behaviors appear as repeated chart patterns on the index chart. The development of these patterns is also consistent so they can be used to calculate price targets.

| ||||

Understanding this larger pattern of market behavior allows investors to see the opportunities when market news creates short-term price dips in the trend.

The news comes and goes. This week it is Dubai and hot money flows. Next week it will be a different issue. Bulls will always find bullish features in the news and the bears will always find something to worry about. I listen to the news, but I follow the market behavior.

The author is an international financial technical analysis expert, an equity and derivatives trader and author of many books on trading techniques. He appears regularly on CNBCAsia and is known as "The Chart Man".?