Annual Reports

Industrial Bank loan growth set to halve

(Xinhua)

Updated: 2010-03-04 14:22

|

Large Medium Small |

Industrial Bank Co, planning to raise $2.6 billion to boost its capital, forecast growth in outstanding loans will almost halve this year as the government orders a retreat from 2009's record expansion.

Outstanding credit is targeted to increase 22 percent to 855 billion yuan ($125 billion) this year compared with 40 percent growth in 2009, according to figures provided by the bank in its earnings statement to the Shanghai stock exchange Wednesday. HSBC Plc unit Hang Seng Bank Ltd owns 12.8 percent of Industrial Bank.

China's banks loaned a record 9.59 trillion yuan last year to support the government's economic stimulus plan to sustain growth amid the global financial crisis. The central bank has ordered lenders to set aside more deposits as reserves twice this year, and regulators have said they will rein in credit expansion to avert asset bubbles and restrain inflation.

"Banks are facing a tighter policy environment in 2010 than in 2009" as the government switches its focus to managing inflationary expectations and changing the structure of growth, the bank said in its statement. "Lending in China this year will revert to steady growth from a rapid pace in 2009."

Bank of China, the nation's third largest by market value, will moderate the pace of lending this year, President Li Lihui said in comments reported by the official Xinhua news agency Wednesday. Last year's credit growth was to meet the special demands of the financial crisis, he was cited as saying.

Capital Adequacy

Fuzhou-based Industrial Bank, whose biggest shareholder is the Finance Bureau of the eastern province of Fujian, said its capital adequacy ratio at the end of 2009 was 10.75 percent. That compares with a ratio of 9.21 percent at the end of June. The China Banking Regulatory Commission's capital adequacy requirement for large banks is 11 percent.

| ||||

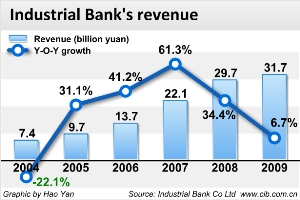

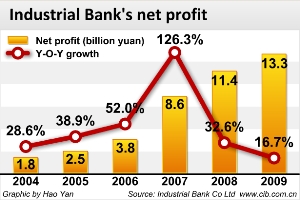

The bank confirmed figures in its report issued in January that full year net income climbed to 13.3 billion yuan from 11.4 billion yuan the previous year. Earnings per share rose to 2.66 yuan from 2.28 yuan.

Industrial Bank rose 0.2 percent to 35.65 yuan in Shanghai trading Wednesday. The shares have fallen 12 percent this year compared with a 5.5 percent decline in the benchmark Shanghai Composite Index.