Top Biz News

IPO rally gathers steam on mainland bourses

By Hu Yuanyuan (China Daily)

Updated: 2010-01-05 08:06

|

Large Medium Small |

Financial services, retail, consumer sectors to drive market, says PwC

Funds raised through China's IPOs will soar 73 percent to exceed 320 billion yuan this year as firms expect IPO markets in Shanghai and Shenzhen to continue to pick up in the first half of 2010, PricewaterhouseCoopers (PwC) said in a report yesterday.

"Along with further growth in domestic demand and GDP, many Chinese companies are ready and waiting to get listed on the Shanghai and Shenzhen bourses this year," said Frank Lyn, China markets leader of PwC, an international accounting firm.

"Financial services, infrastructure, industrial products, consumer goods and retail sectors will continue to be the key driver of the China IPO market in 2010," he said.

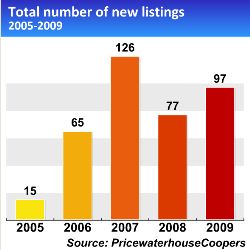

According to the PwC report, the total number of new listings may reach 145 this year, including 15 in Shanghai and 130 on the Shenzhen SME Board and the ChiNext.

Shenzhen-based ChiNext is a NASDAQ-style secondary stock market for start-ups and the Shenzhen SME board is the Shenzhen Stock Exchange's small- and medium-sized enterprise (SME) board.

The introduction of ChiNext has widened the capital raising platform for smaller Chinese enterprises with high growth potential. And the proposed international board will provide a new platform for non-Chinese companies seeking to raise funds.

Lyn estimated that five international companies will make their debut on the Shanghai Stock Exchange this year, and are forecast to raise upwards of 100 billion yuan.

"Investors will be more rational about this year's IPOs, especially for new listings on the ChiNext. And the P/E ratio for listings on the international board will not be very high, given the international average," Lyn said.

Despite lingering uncertainty over the recovery of most of the world's powerful economies, the mainland and Hong Kong became the largest listing markets in the world for fund-raising volume in 2009.

The combined total IPO funds raised in Shanghai and Shenzhen stock exchanges last year was 185.6 billion yuan, an increase of 79 percent from 2008, said the report.

Last year, the total number of IPOs in the two stock exchanges combined was 97, with nine in Shanghai and 88 in Shenzhen - an increase of 26 percent from the previous year. There were no initial public offerings in Shanghai and Shenzhen in the first half of 2009.