Top Biz News

Listed realtors may post profits for '09

By Hu Yuanyuan (China Daily)

Updated: 2010-01-26 08:03

|

Large Medium Small |

|

|

|

Workers work on the Zhujiang New City project in Guangzhou. Some international investors consider the current situation in the property sector as a potential buying opportunity.?[China Daily] |

Volatility takes sheen off shares despite robust sales last year

China's listed-property developers are expected to report a 50 percent increase in 2009 profits, despite their being some of the worst performers in capital markets due to intensive government policies to cool down the feverish sector.

"As real estate sales skyrocketed in the fourth quarter, we expect the industry's overall profit growth to exceed 50 percent for last year, with some property firms even doubling their net profits," said Zhang Taixin, an analyst at China Securities Research Center.

China experienced a property boom last year as sales soared by 75 percent to 4.4 trillion yuan. Prices hit a 15-year high to 4,695 yuan, on average, per sq m, up 24 percent year on year, according to data released by the National Bureau of Statistics.

Shanghai-listed Poly Real Estate Group Co Ltd, one of the country's largest property developers, estimated its 2009 profits shot up 50 percent, the company said in a statement late Sunday. That figure is expected to total 2.24 billion yuan, boosted by strong sales and climbing property prices.

China State Construction Engineering Corp forecast last Thursday its net profit would rise by more than 80 percent in 2009, partly buoyed by a construction boom in the housing sector.

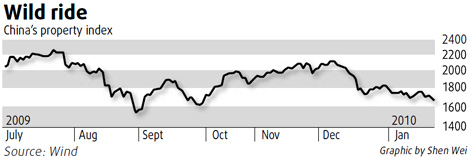

Despite the rosy figures on balance sheets, listed real estate firms' shares reported sluggish performance in the second half of last year. China's property index dropped 38.9 percent after it peaked on July 24, while the Shanghai Composite Index fell only 9 percent during the same period.

The stark contrast between sales numbers and share prices was largely due to the government's tightening of related policies to curb runaway prices, which in turn fueled fears that the measures could hurt profits at listed firms. Yet some international investors see the current situation as a potential buying opportunity.

Noted investor Mark Mobius, who oversees $34 billion of developing-nation assets at Templeton Asset Management Ltd, said in Singapore earlier this month that he plans to increase his holdings in Chinese stocks by purchasing shares that benefit from consumer demand, including developers.

Manop Sangiambut, head of China A-share researcher at CLSA Asia-Pacific Markets, feels that property stocks will rebound as policy changes have already been factored into share prices.

Andrew Mattock, who manages the $342 million Henderson Horizon China Fund, agreed with Sangiam, but said he plans to stay "fairly aggressive" on property stocks as the risks of curbing loan growth were already priced in.

However, domestic analysts remain more conservative, considering policy uncertainties.

"Though property share prices have dropped a lot, I would still suggest investors steer clear of real estate stocks in the first quarter, as further tightening measures are still in the pipeline," said Su Xuejing, an analyst at Changjiang Securities.

| ||||

"The tightening of credit policies will have a serious impact on the property market, since it does work to reduce property sales," said Su. "Moreover, we are expecting an interest rate hike in the first quarter, which will largely squeeze out investment-oriented purchases."

For China Securities' Zhang, while profit growth at property developers will probably slow this year, a tumble is not likely as long as China's economy stays on the recovery track.