Opinion

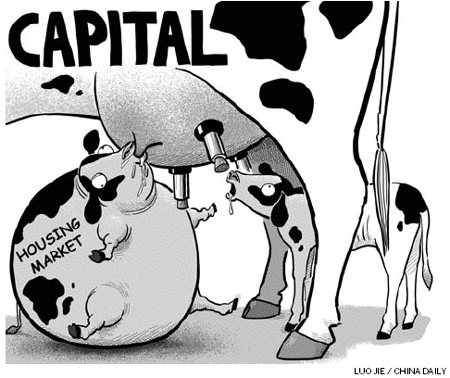

Blame the property boom on capital

By Fulong Wu (China Daily)

Updated: 2010-03-30 13:09

|

Large Medium Small |

Land-use rights for three plots in Beijing were auctioned off for record prices within two days at the end of the National People's Congress (NPC) annual session, which ironically had decided to rein in the skyrocketing housing prices. The successful bidders, as in many cases, were State-owned enterprises (SOEs).

No doubt, China's property market is overheated. But is there a bubble in the real estate sector?

It is necessary to ask this question because we don't know what exactly is meant by a "housing bubble". Often, we tend to consider housing prices as high if they rise beyond the reach of "ordinary people". In this sense, there indeed is a big bubble in the housing market. But housing prices have risen - especially last year - despite low affordability.

Irrespective of whether housing prices were high or low, migrant workers or low-income urban families can rarely afford to buy a house in cities. Hence, when we complain about housing prices being very high, we almost exclusively do so in reference to the middle-class. If we are talking about a bubble in the conventional real estate market sense, the housing market has always had one, and it has continued to grow.

So, what is so special now? It is the financial risk it poses and the damage it could cause to the economy. It is clear that the pumping of a lot of money, or capital liquidity, has caused the housing prices to rise sharply recently. A large part of that money, incidentally, came from the investment to reduce, if not neutralize, the impact of the global recession on China's manufacturing industry.

Soaring housing prices have for long been a contentious political issue. But the record prices that pieces of land have fetched recently can be attributed to the unbridled investments of large SOEs in the property sector.

Such has been the role of the SOEs in raising property prices that on March 18 the State-owned Assets Supervision and Administration Commission (ASAC) had to order 78 of the central government-owned behemoths to retreat from the realty sector.

|

||||

The selectively targeted measures can release the pressure of capital blowing up the property bubble. This would be better than an overall tightening of credit or sudden retreat from the economic stimulus package, which could jeopardize China's economic recovery. If not, the worsening of the investment environment for manufacturing industries may turn more enterprises into property speculators, as it did just before the global recession.

Retrospectively, we can see this most recent boom has been driven largely by capital investment.