World Business

Asia-Pacific firms borrow less amid debt crisis fears

By Henry Sanderson and Shelley Smith (China Daily)

Updated: 2010-05-28 10:18

|

Large Medium Small |

|

|

|

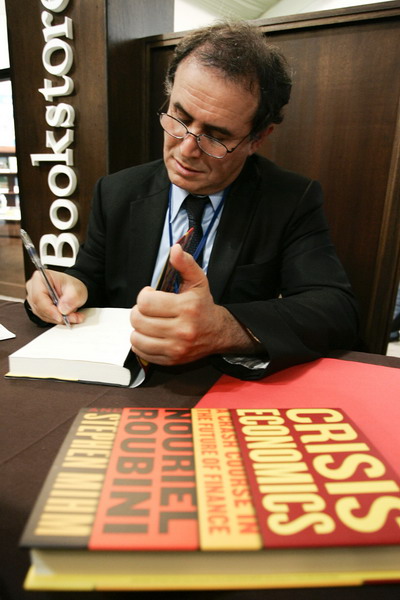

Nouriel Roubini, professor at New York University's Stern School of Business, signs copies of his book during the 2010 Milken Institute Global Conference in Los Angeles. Singapore's trade ministry said downside risks had intensified on May 20 after Roubini said fiscal problems may push Europe into a "double-dip" recession. [Jonathan Alcorn / Bloomberg] |

BEIJING - Asia-Pacific companies are borrowing less for expansion on concern Europe's debt crisis may cut export demand, hampering banks' efforts to revive loan markets shuttered in the global credit freeze.

Syndicated lending in Singapore plunged 72 percent to $1.8 billion this year from $6.5 billion in the same period of 2009, according to data compiled by Bloomberg. It slumped 17 percent in Australia and New Zealand to the lowest since 2004, and 18 percent in Indonesia to the least since 2006, the data show.

"The low levels of deal volumes are because of a hesitation on the part of the corporates to take on fresh leverage," Atul Sodhi, head of loan syndication for Credit Agricole CIB in the region, said. "Lack of demand is the issue here rather than supply" of credit, he said.

While Asia has led a recovery from the deepest global recession since World War II, concern that Europe's debt woes will derail growth has jolted investors and pushed the MSCI Asia Pacific Index down 8.9 percent this year. "Downside risks have intensified," Singapore's trade ministry said May 20 after New York University professor Nouriel Roubini said fiscal problems may push Europe into a "double-dip" recession.

| ||||

About 60 percent of exports by companies in developing Asian nations end up in the United States, Europe or Japan, according to the Asian Development Bank.

The euro has lost 15 percent this year, making Asian goods more expensive for buyers in the 16 European nations that use the common currency.

Australian business investment unexpectedly fell in the three months through March as manufacturing companies spent less on equipment and machinery, the Bureau of Statistics said in Sydney on Thursday. Capital spending dropped 0.2 percent from the previous quarter, when it climbed a revised 6.1 percent.

The three-month London interbank offered rate for dollars, a benchmark for borrowing costs, fell to a record 0.2488 percent on Dec 21 amid signs the world was emerging from recession. It advanced to 0.5378 percent on Wednesday, the highest since July 6, on concern about Europe and rising tensions between the Democratic People's Republic of Korea and the Republic of Korea.

"There's a lot of liquidity in the Asian markets and that means pricing could come down," said Phil Lipton, HSBC Holdings Plc's head of syndicated finance for Asia-Pacific debt capital markets. "However, I think we could potentially reach a shuddering halt very soon if banks' cost of borrowing continues to go up."

Bloomberg News