Money

ABC's IPO reflects changing banking paradigm

By Wang Bo (China Daily)

Updated: 2010-07-08 11:18

|

Large Medium Small |

Foreign partnerships no longer the norm for Chinese lenders

BEIJING - Few key international financial companies appeared in the lineup of foreign investors for Agricultural Bank of China's (ABC) initial public offering, reflecting a subtle change in the relationship between Chinese banks and their Western peers.

As the last of the nation's "Big Four" banks to go public, Agricultural Bank did not rope in any foreign strategic investors ahead of its mid-July IPO. This is a far cry from the situation some five years ago when China sought international backers for the share offerings of the other State-run lenders.

At that time, the other three key State-run banks, namely, Industrial and Commercial Bank of China, China Construction Bank and Bank of China, all sold stakes at an attractive discount to Western financial giants, including Bank of America, Royal Bank of Scotland and UBS.

Yet, in the wake of the global financial crisis, China's envy of the West's financial system has turned to suspicion after several crisis-battered foreign lenders offloaded a big chunk of their Chinese bank shares to clean up their own strained balance sheets.

"Foreign partnership used to be an endorsement for Chinese lenders to boost investor confidence, but now it has become less necessary as Chinese lenders have gained international recognition and credibility," Guo Tianyong, a professor of finance at the Central University of Finance and Economics, said.

In the late 1990s, China's top four lenders were on the brink of bankruptcy due to decades of government-directed lending to unprofitable State-owned enterprises. The government spent some $800 billion to clean up their balance sheets, saddled with non-performing loans, turning the State-controlled lenders into commercial entities qualified for listing.

| ||||

Foreign investors who want a slice of the Chinese lender's IPO have to pay full price, even though there have been concerns over ABC's weak asset quality due to its heavy exposure to the country's less developed, rural areas.

Among the squad of cornerstone investors for Agricultural Bank's float, UK-based financial group Standard Chartered has agreed to take a $500 million allotment, while Rabobank of the Netherlands will invest $250 million.

Both banks have formed an alliance with ABC, seeking to gain a firmer foothold in China through partnering with the country's largest lender by customer volume.

Other notable investors include several Middle Eastern sovereign wealth funds, Australian media company, the Seven Group and US agricultural giant Archer Daniels Midland, each have invested several hundred million dollar into the bank in the hope of exploring business opportunities in the fast growing Chinese economy.

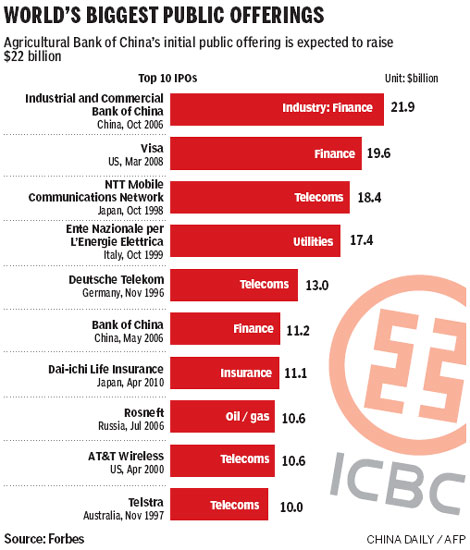

Thanks to the high level of institutional demand, ABC is on track to raise as much as $22 billion from its dual listing in Shanghai and Hong Kong, and may eclipse the $21.9 billion raised by Industrial and Commercial Bank of China in 2006 to become the world's largest IPO on record.

?