Economy

'Wrong' to hit at outbound investment

By Ding Qingfen (China Daily)

Updated: 2010-07-21 09:19

|

Large Medium Small |

BEIJING -?Countries including the United States and India should not politicize outbound investment by Chinese enterprises or abuse investment protection tools to shield their own industries and jobs from the financial crisis, the Ministry of Commerce said on Tuesday.

Such abuse will sour trade and investment relations with China, as well as dampen the confidence of the country's outbound direct investment (ODI) and slow down ODI growth for the rest of the year, the ministry said.

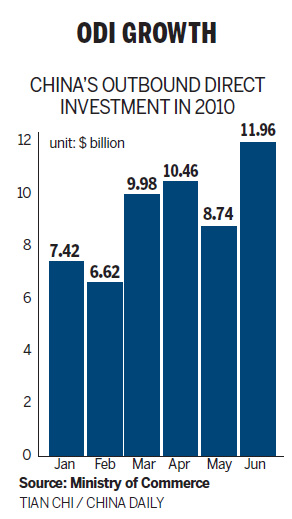

China's ODI surged by 24 percent from a year earlier to $55.18 billion during the first six months, the ministry said at a monthly press briefing on Tuesday.

The investment mainly went to sectors such as mining, commercial services, manufacturing, wholesale and retail.

"The financial crisis has provided Chinese enterprises with a nice opportunity to expand and invest overseas, at a comparatively lower price," ministry spokesperson Yao Jian said.

Despite the rapid growth of China's ODI, Chinese investment abroad has been frequently blocked by other countries, especially the US and India, during the past few months.

The US Congressional Steel Caucus wrote to Treasury Secretary Timothy Geithner in late June, urging the Obama administration to obstruct the proposal by Anshan Iron and Steel Group Corporation, China's leading steel producer, on its $175 million investment in a US rebar facility. [US lawmakers urge probe of Chinese steel investment, Ansteel says US plant investment 'commercial']

The Indian government also blacklisted 25 Chinese telecommunications providers, banning Indian operators from Chinese purchases, Indian reports showed in mid-July.

"On the one hand, Chinese enterprises are encouraged to actively adjust themselves to the changing environment overseas, but on the other hand, we strongly call for some individual nations and regions not to abuse trade and investment measures against China, citing national security excuses," Yao said.

"We don't think it appropriate for them to politicize common commercial investment cases, which will hurt bilateral relations with China," he said.

| ||||

The first-half ODI figure has surpassed that for the whole of 2009, which rose by 6.5 percent year-on-year to $43.3 billion despite the financial crisis.

"I don't think there leaves a big question that China's ODI for 2010 will be less than $100 billion," said Yan Jinny, economist from Standard Chartered Shanghai.

"While the European debt crisis is going on and many more European companies are poised to face operational challenges, more investment from China will probably go to the euro-zone," she said.

During the first half, China's ODI in the US and the European Union increased by 360 percent and 107 percent year-on-year, while investment to ASEAN countries climbed by 126 percent.

'Unfair' to blame China

"It's really unfair that they are blaming China more frequently for its investment environment, while foreign nations themselves are setting more restrictions for Chinese investment," said Li Xiaogang, director of the Foreign Investment Research Center at the Shanghai Academy of Social Sciences.

The investment environment in China was recently put in the spotlight again with many foreign businesses criticizing Chinese authorities for turning hostile against them.

"Loopholes do exist with China's FDI policies, but it is undeniable that the Chinese government is much willing to listen to suggestions from all sources and we are also trying to improve the environment," said Yao from the Ministry of Commerce.

"I don't think there is any other country that could create a better environment for foreign businesses than China."

In June, China's foreign direct investment surged 40 percent to $13 billion, the highest single rise since December 2007.

After failing to gain recognition from the World Trade Organization (WTO) on its first proposal in 2007, China recently submitted a revised proposal on government procurement agreement to the organization, which has been lauded by WTO member nations including the US.

At a meeting with German Chancellor Angela Merkel last weekend in Xi'an, Chinese Premier Wen Jiabao said that allegations of China's worsening investment environment are untrue.