Opinion

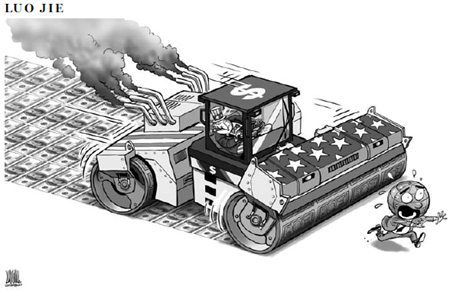

Unknown consequences of QE2

(China Daily)

Updated: 2010-11-09 14:11

|

Large Medium Small |

With oil hitting a two-year high, gold rallying to an all-time peak, and most global stock and commodities markets in a sharp upswing, the US Federal Reserve (Fed) has proved its capability to drive up the world's inflation expectations.

Yet, unfortunately, it remains unknown if the Fed's announcement last Wednesday to purchase $600 billion of Treasuries has any chance of succeeding in effectively reviving the sluggish US economy. Moreover, the second round of quantitative easing, or QE2, has given rise to international concerns that the move will only increase global economic uncertainty.

Last Friday, Zhou Xiaochuan, governor of China's central bank, pointed out that the Fed's move was "not likely" to benefit the global economy, because there may be a conflict between the international role and the domestic role of the US dollar.

The Fed's move to print more money may help boost employment and maintain a low inflation rate domestically, but it will bring a flood of liquidity to the global economy, especially to emerging economies, and drive inflation expectations to dangerous levels.

Last week, German Finance Minister Wolfgang Schaeuble criticized the Fed's capital-injection for its potential to "create extra problems for the world" and cause "long-term damage".

Equally worried was Robert Zoellick, president of the World Bank, who even suggested a modified global gold standard to guide currency movements.

Admittedly, a return to using gold as an anchor for currency values is probably premature, even though gold prices are more solid than ever. But it is now quite obvious that the current international system cannot afford doing nothing about the latest US attempt to revive its economy with the help of the central bank's printing press.

If US policymakers turn a deaf ear to such international criticism over its latest attempt to stimulate its economy's slow recovery, they will risk undermining other countries' efforts to normalize their monetary and fiscal policies for a lasting recovery.

Worse, the phenomenal inflationary impact that QE2 has so far exerted on the global market could be just the tip of the iceberg. There will undoubtedly be unknown consequences of printing such a large amount of US dollars, a key international reserve currency that is widely used in international commodity trade, capital circulation and financial transactions.

The international community should make it an issue for serious discussion at the G20 summit in South Korea later this week. It is necessary to drive home the message that neither a country, nor the world as a whole, can reflate its way out of a crisis as wide and deep as the one that we are all still suffering from.