Energy

Yanzhou Coal targets $1.1 billion in initial sale

By Elisabeth Behrmann (China Daily)

Updated: 2011-05-25 10:17

|

Large Medium Small |

|

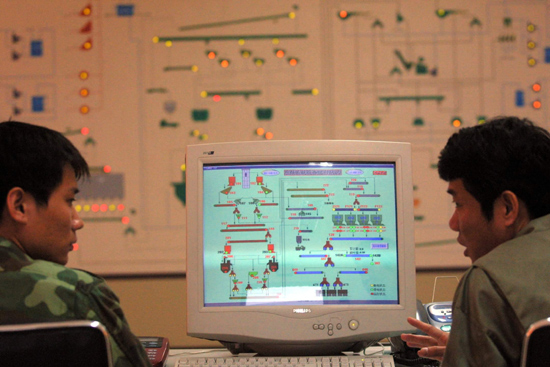

The state-of-the-art information control center of Yanzhou Coal Mining Co. The company may raise more than $1.1 billion in an IPO for its Australian unit. [Photo / China Daily] |

SYDNEY - Yanzhou Coal Mining Co, China's fourth-largest producer, may raise more than A$1 billion ($1.1 billion) in an initial share for at least a third of its Australian unit by the end of the year.

The company is in talks to prepare for the sale with banks and advisers, Ian McAleese, investor relations manager of Brisbane-based Yancoal Australia Ltd, said in response to questions. It has a "strategy to be IPO ready by the end of 2011", he said.

Yanzhou bought Felix Resources Ltd for A$3.1 billion in 2009, China's biggest takeover of an Australian company. An IPO of these assets may be Australia's biggest since the sale of the coal transport company QR National Ltd raised A$3.97 billion in October last year.

"We would like to have our prospectus ready to be able to take advantage of market conditions," McAleese said.

| ||||

Australia's foreign takeovers regulator, the Foreign Investment Review Board (FIRB), ruled at the time of the Felix takeover that Shandong-based Yanzhou must list a minimum of 30 percent of its Australian assets by the end of 2012.

The regulator also required Yanzhou, which trades in Hong Kong and has a market value of $22 billion, to reduce its economic interest to less than 50 percent of the value of the Felix assets at the time of the deal.

"The preferred way to do this is to sell more stock than 30 percent of the total value," McAleese said.

Yancoal, which operates four mines in Australia, the world's biggest coal exporter, had net income of A$415 million last year, according to its website.

The company is looking for a higher valuation in the IPO than the A$3.1 billion sale price because Felix's Morlaarben mine has begun production of 7 million tons a year of thermal coal. Yancoal already owned the Austar mine, bought in 2004, which produces about 1.7 million tons of coking coal annually.

Yanzhou "expects a higher valuation now because the Austar mine will be included in the listing, while Morlaarben is now up and running", McAleese said.

"FIRB has been receptive to the changing business environment affecting Yancoal."

Yancoal also owns a 15.4 percent interest in the Newcastle Coal Infrastructure Group export terminal at Newcastle in New South Wales, entitling the company to 8.3 million tons export capacity under ship or pay contracts.

Bloomberg News

| 分享按鈕 |