Economy

Govt gets earful of tax suggestions

By Zhao Yinan (China Daily)

Updated: 2011-06-17 14:58

|

Large Medium Small |

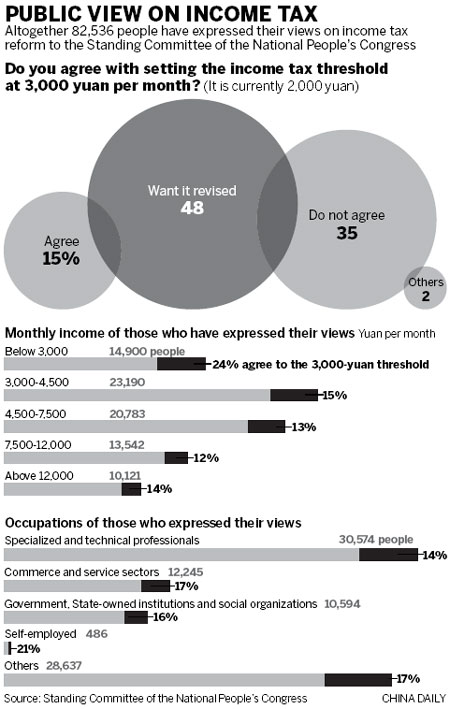

BEIJING - Only 15 percent of respondents expressed satisfaction at a proposed new income tax threshold.

The proposed increase, which was put online to gauge public opinion, received responses from more than 82,000 people.

The increase would see the personal income tax threshold raised from 2,000 yuan ($309) to 3,000 yuan, in addition to cutting the number of tax brackets from nine to seven.

About 15 percent of netizens who responded to the National People's Congress Standing Committee's call for public opinions on the issue are satisfied with the proposal - while others either opposed it or offered their suggestions on the tax threshold or rate.

Among the suggestions, most proposed raising the threshold to 5,000 yuan. Others suggested slashing the entry-level tax rate from the proposed 5 percent to 3 percent, in a bid to further reduce the burden of low-income taxpayers.

According to the National Bureau of Statistics, China's consumer price index increased by 5.5 percent year-on-year in May - a three-year high - exerting heavy pressure on low-income families.

China's top legislature publicized the draft amendment to the Personal Income Tax Law on its website, npc.gov.cn, to solicit public opinions from April 25 to May 31.

The top legislature said nearly half of the suggestions were proposed by people with monthly salaries from 3,000 yuan to 7,500 yuan, while more than 40 percent of the advice came from Beijing, Shanghai and Guangdong.

| ||||

Li Daokui, an adviser to the People's Bank of China and professor at Tsinghua University, said China should implement different thresholds according to the living expenses in different areas.

"Provinces, autonomous regions and municipalities should be authorized to have choices. For instance, 3,000 yuan for those in the west, 4,000 for the central and 5,000 for the east," suggested a Guangdong resident whose named was not revealed.

"The amendment should not only focus on the threshold, but also have to make comprehensive changes on the structure of the tax, as well as pushing forward the reform of the country's taxation system," said Gao Peiyong, a researcher at the Chinese Academy of Social Sciences.

| 分享按鈕 |