Inflation drop may see shift in policy

Updated: 2012-01-13 07:03

By Chen Jia and Wang Ying (China Daily)

|

|||||||||

CPI registers 15-month low as 'monetary flexibility increases'

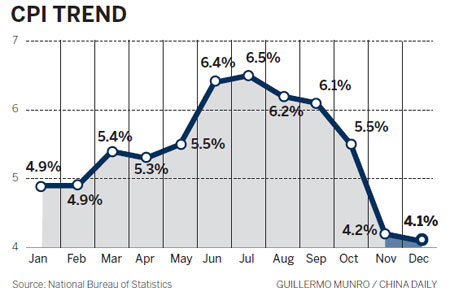

BEIJING - Inflation eased to a 15-month low in December, further fueling speculation that the government may ease monetary policy.

|

Consumer price inflation of 4.1 percent, from the same month last year, saw the continuation of an easing trend over the last five months.

The trend is expected to continue this year and may lead to the Consumer Price Index (CPI) averaging 3 percent as production and exports slow due to Europe's difficulties, economists said.

This was the weakest growth since October 2010, just under the 4.2 percent for November, the National Bureau of Statistics (NBS) said on Thursday.

"It gives more room for the government to change policies" toward a growth-oriented stance, said Li Daokui, a member of the monetary policy committee of the People's Bank of China.

"The prospect of flexibility is increasing."

According to the NBS, consumer prices surged by 5.4 percent in 2011, 1.4 percentage points higher than the government's yearly target. Inflation soared to a 37-month peak of 6.5 percent in July.

The authorities emphasized taming inflation as the top priority last year. Measures to combat it included raising interest rates three times and increasing, on six occasions, the reserve requirement for commercial banks. This is the amount of money banks must hold in reserve and not lend to customers.

"This tighter-than-ever monetary policy has had obvious effects so far and may be loosened in the coming months," Qu Hongbin, HSBC Holdings chief economist in China, said. He predicted that the central bank this year may actually cut the reserve requirement for banks.

"If the CPI declined to less than 3 percent in the middle of the year, the central bank could decrease interest rates by 25 basis points," he said.

The December Producer Price Index (PPI) gained 1.7 percent year-on-year, the slowest growth for two years. The index registered 2.7 percent in November and 5 percent in October. The average increase of this index was 6 percent last year, according to the NBS.

The manufacturing sector is deteriorating amid weakening overseas demand, economists said.

"In the coming months the eurozone is likely to suffer a more difficult situation and its economy may be even worse with a high likelihood of recession," Stephen King, global chief economist with the HSBC, said in Beijing on Thursday.

The gloomy external scenario may drag down growth of the world's second-largest economy to 8.5 percent this year, compared with an expected 9.2 percent for 2011.

Shi Dingwei, general manager of Ningbo Matrix Sport Goods, a snowboard manufacturer in East China's Zhejiang province, said that 2012 will be "extremely difficult" because of the ongoing European debt crisis.

"To offset losses we are planning a gradual shift to the domestic market," Shi said.

The central bank in December cut the reserve requirement by 50 basis points, the first such move in three years. This freed 400 billion yuan ($63.3 billion) back into the market.

New loans jumped by 640.5 billion yuan in December, the biggest monthly increase since April.

"These signaled a start of the policy easing cycle," said Stephen Green, chief economist with Standard Chartered Bank. "We assume new lending may rise by 8.5 trillion yuan this year, compared with 7.5 trillion yuan last year."

However, some economists warned that easing too fast may spark a systematic financial risk because of the "huge" money supply.

Ba Shusong, an economist with the Development Research Center under the State Council, said on Thursday that the 85.16 trillion yuan broad money supply, which is known as M2, was already "so extremely large" that any further increase may lead to a price surge.

"Soaring labor costs may be the main driver for the CPI this year, which means monetary policies should not be eased too much," he added.

Wei Tian contributed to this story.

Related Stories

Equities gain as CPI data reassures investors 2011-11-10 07:57

Dec inflation dips to 4.1%, 2011 CPI at 5.4% 2012-01-12 09:45

Dec inflation dips to 4.1%, 2011 CPI at 5.4% 2012-01-12 09:45

CPI hits 14-month low 2011-12-10 08:18

- China's forex reserves hit $3.18t

- Beijing housing policy to continue

- CBRC restricts trust product sales

- RUF eyes the 'top of the pyramid' in China

- UK retailers paying in yuan

- PBOC to further interest rates marketization

- Revenues of China's customs duties top 1.6t yuan

- West area tops illegal land deals