China's stock market has great growth potential as small companies seek to raise funds, providing more opportunities for foreign exchanges to cooperate with local ones, Duncan Niederauer, CEO and director of NYSE Euronext, said on Tuesday.

"In the next decade, more than 5,000 Chinese companies are likely to go public, creating more job opportunities and boosting economic growth," said Niederauer.

Several companies from the Chinese mainland are waiting to launch IPOs in the US market, he said.

Current conditions in US capital markets are "sound", although the number of Chinese companies that go public in the US is unlikely to approach the level of two years ago, he added.

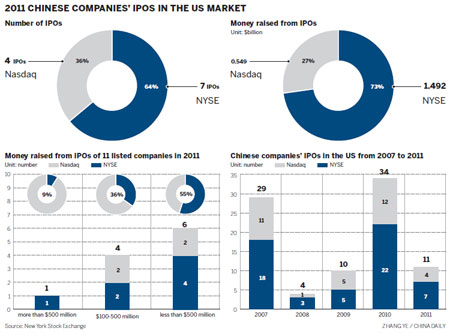

In 2010, 22 Chinese companies went public on the NYSE Euronext's exchanges. Last year, however, only seven went public on the exchanges, raising a total of $1.49 billion.

There are 104 Chinese companies listed on the NYSE Euronext's exchanges: 81 companies on the NYSE, 20 on the Amex and three on Alternext. Most of those are small and medium-sized innovative private companies.

The Vipshop, an online seller of luxury goods, was the first Chinese IPO on the NYSE this year, raising $71.5 million in gross proceeds.

Gao Ting, chief China strategist with UBS Securities Co Ltd, said that as the European debt crisis might recede somewhat in the third quarter and China's economy might pick up in the second quarter, more Chinese companies might hold IPOs overseas in the second half.

"We should realize the importance of the Chinese market, as in the next 20 years capital is expected to freely flow into and out of the country", while the Chinese currency will play a more significant role in the global financial system, he said.

Niederauer predicted that Shanghai may become one of the top three global financial centers in 10 years, with London and New York, as China's economy is still on a fast-growth track.

The New York-based group of exchanges is willing to cooperate with stock exchanges in Shanghai, Shenzhen and Hong Kong to help more Chinese companies raise funds in the primary market.

The company and the China Financial Futures Exchange signed a memorandum of understanding on May 16 to promote a bilateral partnership to support the development of the exchanges' futures and options markets.

It also reached agreements with other Chinese exchanges, including the Dalian Commodity Exchange and Zhengzhou Commodity Exchange, to explore opportunities for information sharing, exchanging and training, as well as researching strategies for the derivatives market.

NYSE Euronext manages seven equities exchanges and seven derivatives exchanges in six countries.

At the end of April, the total market capitalization of NYSE Euronext-listed companies reached $23.5 trillion.

chenjia1@chinadaily.com.cn