As fundraising becomes more difficult in the Chinese venture capital and private equity markets and the demands on limited partners are made stricter, developing a fund of funds is becoming increasingly popular in China among investors.

A fund of funds in VC and PE markets involves putting money into several equity investment funds with excellent records rather than a single one.

Related reading: Secrets of a successful PE firm

Beijing Flourish Libra Venture Capital Co Ltd finished its first round financing of 130 million yuan ($20.56 million) in its Flourish Libra FOF III in May. The FOF put cash into Fosun Grand Fund, a PE fund focusing on consumption, technology and industrial upgrades of the Chinese private conglomerate Fosun Group.

China Development Finance Co Ltd and Suzhou Ventures Group Co Ltd announced in April that their Guochuang FOF, China's first State-level FOF established in 2010, had raised an initial 9 billion yuan. Its managers are seeking cooperation with potential investors such as the National Council for Social Security Fund. The final target totaling 60 billion yuan for this FOF is expected to be achieved by the end of this year, they said.

"I hope more overseas professionals in the FOF business can come to China and help our equity investment firms broaden the channels of fundraising. Support from the government and large institutions is also very important," said Jin Haitao, chairman of Chinese leading equity investment firm Shenzhen Capital Group Co Ltd.

"Fundraising has remained in a depression this year. But that means the FOF business has great potential. Individual investors cannot be a sustainable financing source for general partners (equity investment firms) and the number of qualified institutional investors is not that large in China, so the demand for FOFs should be strong," said Feng Po, an analyst at China Venture Group, a leading Chinese PE research agency.

Feng added that limited partners also like to put their money in FOFs because they can yield a more steady return over the long term when compared with directly investing in funds.

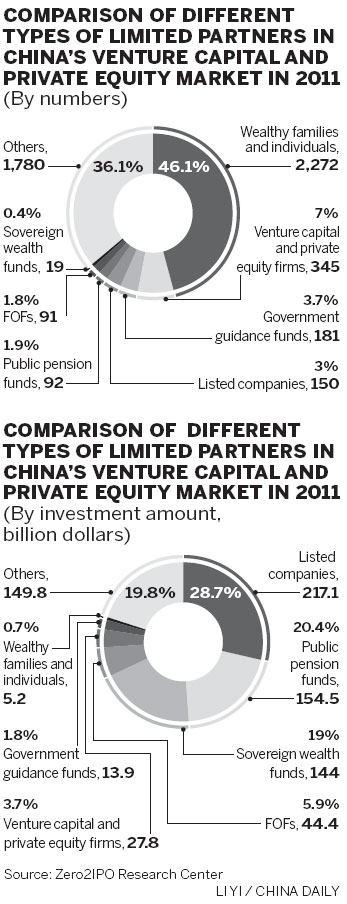

As the global economy continues to weaken, Europe's debt troubles become more serious and Chinese economic growth slows, 150 VC and PE funds that can invest in the Chinese market raised $8.59 billion in the first half of this year. That amount was down 77.1 percent year-on-year, said a report by Zero2IPO Group, a VC and PE research house.

China has set the threshold at 10 million yuan ($1.6 million) this year for a single investor putting money into a VC or PE fund in an attempt to help the sector develop steadily, said Liu Jianjun, an official of the fiscal and financial affairs department under the National Development and Reform Commission.

caixiao@chinadaily.com.cn