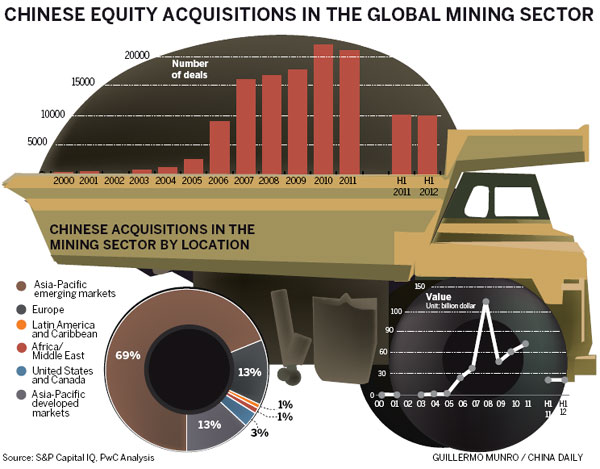

The number of China-led mining merger and acquisition deals nearly doubled in the first half of 2012, despite the slowdown in the world's second-largest economy, according to a report from international accounting giants PricewaterhouseCoopers (PwC).

China accounted for 13 percent of all the mining M&A deals completed in the first half of the year, against 7 percent in the same period last year, the report showed, although the global total fell in number by more than 30 percent, due to the global downturn and a drop in commodity prices, said the report.

Though China's growth has advanced by what the market views as a modest 7.6 percent in the second quarter after decades of averaging 10 percent annually, officials said demand for mining deals still appears strong.

"While we see few buyers, now is the time when people should buy, as history shows this is when bargains are achieved," said Tim Goldsmith, PwC's global mining leader.

"Also, with market conditions expected to remain tight for months to come, miners are looking for innovative ways to fund projects and future growth, a trend that will continue into 2013."

Ken Su, PwC China mining practice leader, said amid reduced short-term demand for steelmaking ingredients, coal and iron ore, as domestic production targets flatten out, the long-term demand for these key metals along with others such as copper used in manufacturing and construction, is still expected to remain strong.

"While Chinese companies could potentially slow down their rate of doing deals in the near term, China-based companies are continuing to evaluate opportunities and will still seek to take advantage of global conditions to secure overseas resource assets at attractive valuations," Su said, adding areas of particular focus include North America, South America and Africa.

Globally, the report showed mining M&A volume fell more than 30 percent to 940 transactions in the first half of 2012, due to the global economic recession and a drop in commodity prices, according to the report.

The total value of deals for the first half of the year was $79 billion, against $71 billion for the same period last year, but that increase was mainly contributed by Glencore International PLC's massive $53.6 billion offer for Xstrata PLC.

Excluding that, the total value of transactions announced drops to $25 billion, a third of last year's first half-year total, reflecting global market uncertainty, the report showed.

According to data from Thomson Reuters and PwC, outbound deals in the resources and energy sectors continued to dominate, representing 44 percent of the number of outbound transactions in the first half of 2012 on a combined basis compared to 36 percent in the same period of 2011.

Given China's continued growth and steady demand for resources, the trend of resource deals taking up the major component of overseas deals is likely to continue beyond 2013, it said.

"China's miners have shown that despite the macro global challenges, they still have an appetite for doing deals abroad," Sun added.

Among all mining categories, gold dominated M&A transactions in the first half, re-establishing its first place against other metals such as copper and coal, whose values have fallen while the price of bullion remained steady.

It represented the highest value of transactions at 26 percent and the highest volume at 29 percent, excluding the Glencore-Xstrata deal, according to the report.

The drop in gold equity valuations and the rising gold price are driving the number of M&A deals and PwC said it expects more gold M&A activity in coming months.

"Chinese gold companies are actively looking at assets overseas, and while other sub-sectors may slow down we may even see an increase in gold related deals by Chinese companies in the near term," Su added.

huyuanyuan@chinadaily.com.cn