Japan increased its holdings of United States Treasury securities by more than China did in August, making it more likely that China will cease to be the chief foreign creditor to the US.

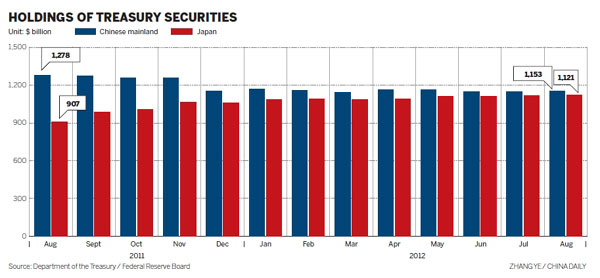

China's holdings of long-term US financial assets increased by $4.3 billion to $1.154 trillion in August, showing their second consecutive monthly increase after the country reduced its holdings in June, according to a report on the US Treasury Department's website on Tuesday.

Meanwhile, Japan added $5.3 billion to its holdings in August, taking them to $1.122 trillion and extending its purchases of the assets into a fifth consecutive month.

China's holdings have decreased by $124.9 billion in the past 12 months, or by nearly 10 percent, while Japan has increased its by $214.5 billion, or by 23 percent year-on-year.

With the difference between the two countries' holdings now amounting to $32.1 billion, analysts say China could cease being the chief foreign creditor to the US as soon as this year.

"The huge stockpile of China's holdings of US debt mainly results from the country's long-term trade surplus and lack of investment channels," said Wang Zihong, director of the economics office of the Institute of American Studies at the Chinese Academy of Social Sciences.

"But faced with greater pressure from the sluggish global economy this year, China's trade situation isn't allowing much of a trade surplus to exist," Wang said.

If Japan again becomes the chief foreign creditor to the US, that will mark the second time it has surpassed China to claim that title.

China became the largest foreign holder of US Treasury securities, overtaking Japan, for the first time in September 2008. Japan reclaimed its position in September 2010, only to cede it again later.

"Let's not pay a lot of attention to (which country) is the number one US creditor," Wang said. "This is not the Olympic gold medal list. We'll just purchase the amount we need."

"Buying and selling US debts in the short term is meant to maintain the value of our nation's foreign currency assets, which is our top priority," said He Weiwen, co-director of the China-US/EU Study Center at the China Association of International Trade.

China's decision to reduce its holdings of US debt during the past 12 months showed its determination to diversify its foreign assets, he said.

"China is still going to keep a fair amount of these holdings in its portfolio, but I don't see a need to add much more ... for the recent QE3 (third round of quantitative easing) has weakened the dollar and led to a depreciation of dollar assets."

"Although historical experiences have told us that the value of the dollar is likely to rebound, we should remain cautious about US Treasury securities."

Meanwhile, He said China is reforming its system for administrating foreign exchange.

Some think the slower purchases of US securities will leave China faced with a dollar shortage. But He said it is still too early to make such an assertion.

Japan's Treasury purchases have come amid attempts to defend the yen against appreciation that could impede the country's exports, He said.

Following the US Federal Reserve's recent decision to embark on another round of stimulus, Japan has said it may intervene again in the currency market.

"We still have a great need for overseas money," said Dominic Konstam, head of interest-rate strategy in New York at Deutsche Bank AG, one of the 21 primary dealers that trade with the Federal Reserve.

"Whatever deficit we're running, we're going to supply a lot of Treasuries and someone's going to buy them. And if it's not China, it will be someone else."

Foreign investors made $42.9 billion in net purchases of US Treasury notes and bonds in August, down from $49.5 billion the month before. Private foreign investors bought a net total of $24.4 billion in Treasury notes and bonds after buying a net of $24 billion the previous month.

weitian@chinadaily.com.cn