But Moody's warning on asset quality, profitability, and efficiency

Moody's Investors Service has maintained a "stable" outlook for the Chinese banking system over the next 12 to 18 months, but has given asset quality, profitability, and efficiency a "negative" outlook, analysts at the rating agency said on Thursday.

The ratings agency warned that the interim results of major Chinese banks had signaled a more visible deterioration in asset quality as non-performing loans, special mention loans and delinquent loans all rose during the first half.

"However, a stabilizing economy and the latest third quarter results do not indicate that asset quality continues to trend materially lower," said Hu Bin, a vice-president and senior analyst at Moody's.

Non-performing loans among Chinese lenders had increased for four consecutive quarters - the longest period of asset-quality deterioration since 2004, according to data from the China Banking Regulatory Commission.

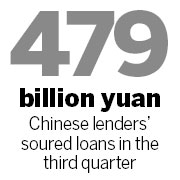

In the third quarter, soured loans rose by 22.4 billion yuan ($3.6 billion) to 478.8 billion yuan. The NPL ratio against total outstanding loans stood at 0.95 percent at the end of September, up 0.01 percentage point from three months earlier.

Hu noted that although NPLs grew slower than expected, delinquent loans - an indicator of future bad loans - surged among almost all major lenders, and should be given particular attention by the sector.

In the first half of the year, Shanghai Pudong Development Bank Co Ltd, for instance, saw an increase of nearly 82 percent in delinquent loans, while China Minsheng Bank Corp Ltd reported a rise of 63 percent, and Ping An Bank of 51 percent.

Christine Kuo, a vice-president and senior credit officer at Moody's, said, however, that as long as China's economic growth remained stable, there would be no sharp increase in soured loans.

Analysts said that China's economic recovery continues to gain momentum as the year nears its end.

The latest evidence of that came on Thursday, with the HSBC Flash China Manufacturing Purchasing Managers' Index bouncing back to expansionary territory for the first time in 13 months, to stand at 50.4 in November, up from October's final index of 49.5.

PricewaterhouseCoopers released a report on Thursday, which suggested that as uncertainty remains in the domestic and global economies, banks should continue to closely monitor the quality of their credit assets during the fourth quarter.

"It will be important to note whether the big jumps in overdue loans at the end of June, turn into bad loans by the year end," the PwC report said.

"With bank profit growth already slowing, market-oriented reforms such as changes in interest rates will add to the pressure."

In the first three quarters of 2012, it noted that five major State-owned commercial lenders registered average profit growth of 14 percent, practically unchanged from the first half.

But the profit growth of five major joint-stock, listed banks slowed to 28 percent from 32 percent at the end of June.

It added that tougher capital adequacy standards, to become effective at the beginning of 2013, will also put pressure on lenders' asset and liability management capabilities.

Hu said that he thought the capital positions, particularly Tier 1 capital ratios, of Chinese banks would be sufficient to meet the new requirements, but they still lag behind the increasingly conservative standards of major international counterparts.

"After the regulators announce new guidelines encouraging banks to develop some new capital instruments, probably hybrid securities, we expect them to actively tap those next year, and the gap in terms of Tier 1 capital adequacy will be narrowed," he said.

Hybrid securities generally refer to securities combining both debt and equity characteristics, for example, convertible bonds.

Wang Zhaoxing, vice-chairman of the China Banking Regulatory Commission, said on Tuesday that the guidelines allowing banks to introduce new instruments to raise capital would be released "very soon", probably in December.

Kuo from Moody's added: "I think for Chinese banks, the more fundamental question is whether they would have sufficient earnings to support the credit growth."

wangxiaotian@chinadaily.com.cn