|

UBS AG's wealth management department in Beijing. The bank recently established its locally incorporated, wholly foreign-owned bank, UBS (China) Ltd, allowing it to offer a greater range of products and services. [Photo / China Daily] |

Bank boosts wealth management as number of affluent people rises

UBS AG, a leading Swiss Bank, will further strengthen its wealth management business in China, the bank's global chairman, Axel Weber, told China Daily.

This strategy is in line with UBS' global reshuffle that cuts back its investment banking business and places more emphasis on its "core DNA" of wealth management.

"China, as one of UBS' most important markets, will continue to be key for our new strategy," Weber said during his first visit to China after becoming UBS chairman last year.

The bank just opened its locally incorporated, wholly foreign-owned bank, or WFOB, UBS (China) Ltd, which serves as a pillar in UBS' domestic multi-entity platform.

The subsidiary bank status is a critical prerequisite to conducting the broad range of renminbi business, which is key to the success of the firm's wealth management, credit and rates businesses in China.

"It is UBS' plan to be one of the leading wealth management providers in China, and the subsidiary bank is key to reaching this goal," Weber said.

WFOB status allows UBS to offer products and services that include a full range of renminbi trading capabilities in the interbank market, as well as structured and Qualified Domestic Institutional Investors' products.

Around 40 foreign banks, including JPMorgan Chase & Co, Morgan Stanley and HSBC, have already set up China units, and some have been injecting additional capital into them to fuel their expansion.

Globally, the wealth management business accounts for 50 percent of UBS' portfolio. But the figure in China is lower.

The total value of private investable assets in China reached more than 73 trillion yuan ($11.6 trillion) in 2012, up 14 percent from the previous year, according to a report by Boston Consulting Group and China Construction Bank Corp.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

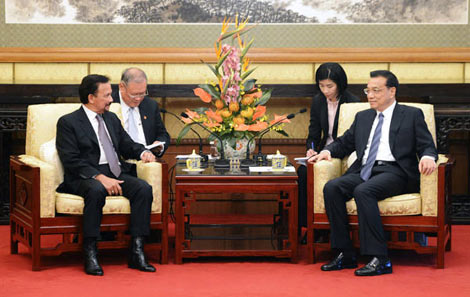

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show