CSRC set to oversee private funds in public securities

Privately raised funds for investment in publicly issued securities will be regulated by the China Securities Regulatory Commission, which will strive to control financial risks and protect investors' interests, the top regulator announced on Wednesday.

So-called "sunshine private fund" management companies - financial institutions that invest private funds into the stock market, as well as private equity and venture capital companies - should register with the Asset Management Association of China if the total investment value in publicly issued securities exceeds 100 million yuan ($16 million), according to a CSRC policy draft.

Publicly issued securities include shares, bonds and derivatives under CSRC jurisdiction.

Before applying for registration, a financial institution's paid-in capital should be more than 10 million yuan, and the company should have no record of illegal activities for the last three years, the commission said.

It also said that the asset management association should report to the CSRC any fund with more than 100 million yuan or with more than 50 holders.

This draft of the new regulation on Wednesday began a month-long solicitation of public opinion.

This will be the first specific regulation for privately raised funds after the Standing Committee of the National People's Congress, the country's top legislature, adopted a modification to the Securities Investment Fund Law on Dec 28.

The new law confirms the legal status of the private fund.

"The principle is to lead a healthy development of the private fund sector and avoid illegal financing activities that hurt investors' interests," said a CSRC official who is in charge of the fund management department.

Hang Kang, vice-chairman and secretary general of the Asset Management Association of China, said the regulation should ensure the safety of private funds and protect investors from fraud.

"The regulation can also stop selling high-risk financial products to investors with low-risk tolerance," Han said.

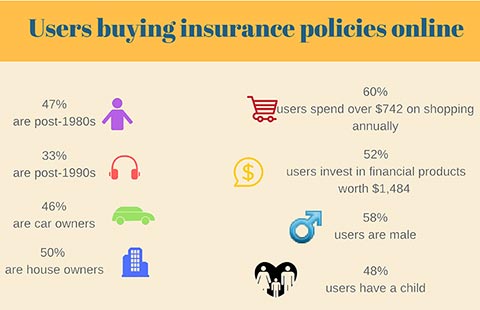

The regulation says that "individual investors of private funds should have at least 2 million yuan in terms of financial assets in the family, or have more than 200,000 yuan individual average annual income or no less than 300,000 yuan family average annual income in the last three years."

A manager, who declined to be named, from the Gold Buffalo Investment Co Ltd, a private equity company in Beijing, said that the new regulation can better control investment risks in the secondary stock market. "Meanwhile, the illegal activities of insider trading and misappropriating fund assets are expected to be reduced," the manager said.

The CSRC has not yet described specific registration rules for private fund that invest in non-public equity transactions, the manager said.

Currently in China, the CSRC, the China Banking Regulatory Commission and the National Development and Reform Commission all have regulatory responsibilities concerning private equity and venture capital companies' business. Some areas are even under redundant supervision, analysts said.

"We are working with the financial supervision department of the State Council to promote the unity of regulation standards," the CSRC official said.

chenjia1@chinadaily.com.cn