China's securities watchdog has completed arrangements to further liberalize the country's stock markets by raising or removing the limits on investment by foreign institutional investors.

The move was welcomed by domestic stockbrokers and investors who hoped the expected inflow of liquidity could help sustain the market turnaround.

"It is good news that the authority is expanding the channels for investment, which brings hope that there will be more capital in the market," said an unnamed insider with a fund management company.

But other analysts said the key issue remains investors' valuation of China's stock market. If they don't have confidence in the market, inflow will be limited, they said.

The China Securities Regulatory Commission said on Sunday it will soon release details of the new rules under which China will allow more institutions to enter the scheme. Currently, the Renminbi Qualified Foreign Institutional Investor (RQFII) scheme is only open to fund management and securities firms.

Meanwhile, the commission will lift the limit on investors' portfolio composition to allow more capital to flow to the stock markets, Xinhua News Agency said on Monday.

Under existing RQFII rules, investors must invest no less than 80 percent of yuan funds they raised in fixed-income securities, with the remaining portion in stocks.

"The regulatory changes will make the RQFII program more attractive by giving investors more choices in what assets to buy on the Chinese mainland," said Dariusz Kowalczyk, senior economist at Credit Agricole SA.

The changes will also increase the number of intermediaries offering services to investors. "Thus, we expect interest in the program to grow and more funds (renminbi traded offshore) to be channeled into the mainland," he said, adding that a larger proportion would likely go into equities.

This will have some positive impact on A shares in the short to medium term, he added.

Cai Yiqing, executive director of Nomura Securities Shanghai Representative Office, said: "The revision will inject positive energy into the A-share market."

China needs stable long-term investment for its capital market to become better integrated with the international one, and to provide stable return on long-term investment, he said.

Cai said that according to the Japanese media, as RQFII business expands, there will be two A-share exchange-traded funds, or ETFs, listed on the Tokyo Stock Exchange, which should facilitate Japanese investors investing on the A-share market.

A research paper from North Square Blue Oak Ltd, a London-based investment bank, said on Monday: "The move is a further boost to the inflow of long-term institutional funds that can help stabilize prices in the market. The CSRC has greatly increased the quotas for both QFIIs and RQFII since last year, but RQFII investment is lagging far behind expectations.

"More than 100 billion yuan ($16.1 billion) worth of quota is idle in Hong Kong, the major offshore RMB center. The removal of restrictions will facilitate investment in the domestic market, especially the A-share market," it added.

China's A-share market saw a strong rally from early December, when it hit a four-year low of 1,949 points. But it has fluctuated since last week after the seven-day Spring Festival holiday, with the Shanghai Securities Journal saying offshore capital is temporarily reducing holdings of A-shares.

The Shanghai Composite Index rose by 0.5 percent to 2,325.82 on Monday.

China launched the RQFII scheme in December 2011 to allow a maximum of 20 billion yuan worth of exchange-traded funds raised offshore to be invested in the domestic capital market. The investment quota has been gradually increased to 270 billion yuan.

The regulator has said it is considering launching 100 billion yuan quotas for RQFII in Taiwan.

An official from the commission said the new rule will soon take effect.

The improved policies are expected to support and guide RQFIIs from Taiwan, and the detailed rules are still being studied, the commission official said.

As the world's largest offshore yuan trading center, Hong Kong contributes to most of the RQFII funds and now has 200 billion yuan in quotas, according to the commission.

By the end of January, the State Administration of Foreign Exchange had approved a 70 billion yuan quota for 24 RQFIIs.

Contact the writers at xieyu@chinadaily.com.cn and chenjia1@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

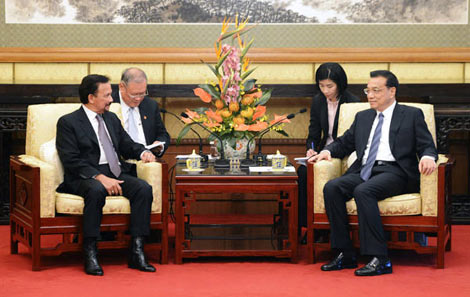

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show