The People's Bank of China has signed an agreement with the Monetary Authority of Singapore to double the size of a currency-swap arrangement, the two sides said on Friday.

Originally agreed at 150 billion yuan in 2010, the swap has been increased to 300 billion yuan ($48.24 billion), or 60 billion Singapore dollars.

The arrangement will be effective for three years and could be further extended if both sides agree.

"The extension aims at boosting bilateral financial cooperation, facilitate trade and investment, and provide short-term liquidity support for the stability of the financial market," the PBOC said.

The move comes a month after the Chinese central bank approved the Singapore branch of the Industrial and Commercial Bank of China as the clearing bank in Singapore, an indication the Southeast Asia country could become the Chinese mainland's third offshore yuan center after Hong Kong and Taiwan.

The expansion of the agreement makes Singapore's swap line the third largest, after Hong Kong (400 billion yuan) and South Korea (360 billion yuan), signaling that policymakers are projecting a sizable yuan market in Singapore.

Australia and New Zealand Banking Group analysts said in a research note that they expect the swap arrangement could be further increased to 400 billion to 500 billion yuan, using Hong Kong's deposit of 624 billion as a benchmark.

"The agreement is a complementary measure to support ICBC as the clearing bank.

"It appears that the formal launch of the offshore RMB business in Singapore should come soon," the note said.

As of last June 2012, yuan deposits in Singapore stood at about 60 billion yuan.

The currency has been gaining popularity worldwide as China accelerates its pace of expanding offshore renminbi hubs and gradually achieves convertibility of the renminbi under the capital account.

The Bank of England said in January it is prepared in principle to become the first G7 central bank to enter a foreign exchange swap agreement with China.

A Standard Chartered Bank index measuring the global use of the yuan registered a new high in January, as trade settlements and other yuan-denominated international payments continued to grow.

The lender said on Thursday that payments through Hong Kong, Singapore and London had hit record highs, and cross-border renminbi payments through Singapore rose 30 percent from a month earlier.

Yi Gang, PBOC's deputy governor, said on Wednesday that he expected the exchange rate of China's currency to remain stable, with greater flexibility.

He said the central bank had reduced its intervention in the currency market, and the currency is very close to its equilibrium level.

Contact the writer at wangxiaotian@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

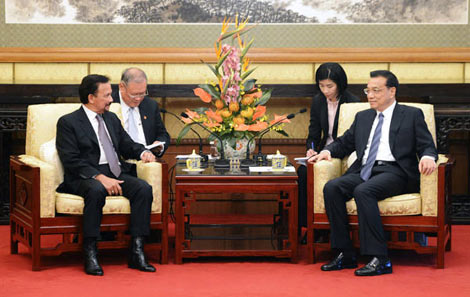

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show