|

|

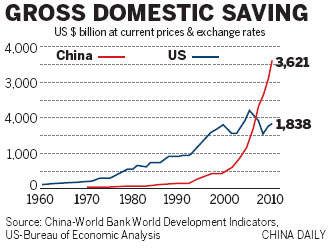

But by every indicator the rate of growth of China's banks is many times higher than that of their US competitors. By revenue China's banks were 16 percent as large as US banks in 2007, and by last year they were 74 percent as large. By assets the corresponding figures were 30 percent and 98 percent, by market valuation 43 percent and 117 percent, and by profit 17 percent and 155 percent.

China's far more rapid buildup of domestic finance means that the balance will progressively and rapidly move in favor of its institutions. So before long China's banks will overtake US banks on all measures. China's underlying financial strength is rapidly being transformed into institutional strength in its banking system.

Where US banks traditionally held a strong lead over China is that China's were essentially domestic banks but US banks operated globally. However, this is beginning to change as China's banks go global.

First to globalize were China's development banks. During 2005 and 2011 China Development Bank and Export-Import Bank of China (Exim Bank) provided more than $75 billion in loan commitments to Latin America. In 2010 their $37 billion commitment was more than that of the World Bank, Inter-American Development Bank and United States Export-Import Bank combined. In Africa, China's Exim Bank has lent more than the World Bank every year since 2005, its loans being $15 billion in 2011.

But now globalization of China's commercial banks is proceeding rapidly. By the beginning of this year, ICBC operated in 39 countries with overseas assets of $170 billion, a 30 percent increase on 2011. The stability and state guarantee of China's banks is attractive compared with the continued scandals from US and European competitors, making it clear that developing the necessary management skills is now the primary difficulty in expanding China's banks' overseas operations.

In a vital international financial center such as the Middle East, the focus of global oil money, the rate of expansion of ICBC's assets last year was 29 percent to $4 billion while profits rose 69 percent.

China's banks have so far concentrated on developing countries, which are growing more rapidly than developed ones. For example, key acquisitions were ICBC's purchase of a 20 percent stake in Standard Bank, South Africa and Africa's largest bank. The advantage of the combination of Standard Bank's local knowledge throughout Africa and ICBC's huge financial firepower is evident. ICBC's shareholding in South Africa Standard Bank also made it easy to buy Standard Bank's Argentinian subsidiary, consolidating ICBC's position in Latin America.

This initial concentration on developing economies resembles the "countryside surrounds the cities" strategy of China's telecoms giant Huawei and other Chinese industrial companies. But the financial strength of China's banks gives them the opportunity to directly expand operations in developed economies.

Bank of China and ICBC are now active in New York's property market, while last year ICBC carried out China's first takeover of a US bank with Bank of East Asia. The international expansion of yuan operations - with the world's largest foreign exchange dealing center, London, trying to compete as an offshore operator with Hong Kong and Singapore - centrally involves China's banks.

Globalization of China's banks cannot be instantaneous. But the problems involved are time in acquiring permits, training management, creating infrastructure and other things, rather than fundamental financial strength. Overcoming these difficulties, given the unparalleled financial muscle that can be applied, is simply a matter of time.

How should the situation be summarized? It is sometimes assumed manufacturing is China's strongest industry. This is a mistake. China is the world's largest manufacturer and largest manufacturing exporter. But a substantial part of China's manufacturing output, and half its exports, are still by foreign companies. It will take significant time to build the power of China's own manufacturing companies. But the foundations of China's banks are already those of an emerging financial superpower. It is only a matter of time, a rather short one, before that translates into an equivalent strength of China's global finance companies.

Within a decade a list of the 100 most influential people in world finance will not contain four from China. It is likely to be dominated by figures from China.

The author is a senior fellow at Chongyang Institute for Financial Studies, Renmin University of China, and former director of economic and business policy for the mayor of London. The views do not necessarily reflect those of China Daily.

China's upgraded growth model provides fresh opportunities for world

China's fiscal policy over past 5 years

China 'still unsure' about creating financial mega-regulator

Financial risk biggest challenge for China: economist

Financial statistical system needs overhaul: official

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show