Slowdown chill equity investment firms

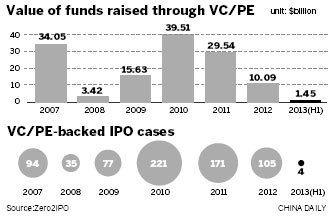

The Chinese private equity and venture capital markets have faltered amid a weakening economy and a freeze on initial public offerings.

In the first half of 2013, only $7.83 billion was raised by equity investment funds related to China, marking the first decline in investable funds into the mainland market from this sector, according to a report from Zero2IPO Research Center.

The report said 516 deals were made in the first half of the year, down 45.2 percent year-on-year. value of the deals fell 20.9 percent to $9.9 billion.

Although activity by PE and VC investment firms has shown signs of a revival since the second quarter, the slowing economy and difficulties in exiting investments are keeping the overall condition from improving.

"Another important reason for the decline was the fierce competition among PE and VC firms, which made deals much more expensive," said Luo Yu, an analyst at Zero2IPO Research Center.

Luo said firms are proceeding more slowly and paying closer attention to their distinct advantages.

Only 73 exits were made in the first half, including 27 through mergers and acquisitions, 15 by equity transfers and 13 via initial public offerings. It was the first time that M&A deals were more popular exit strategies than IPOs.

Wang Chaoyong, chairman and chief executive officer of ChinaEquity Group, said exit strategies are still the key issue for PE investors, and the resumption of IPOs will be important in the second half.

Shan Xiangshuang, chairman of CSM Group, a major Chinese PE company, welcomed the coming IPO restart and said that the Chinese PE and VC market is undergoing a transformation.

"When the macroeconomy and market are changing, many PE and VC firms are trying M&As to exit and participating in the securities and insurance markets," said Shan.

IPOs are "still the main way to exit. Without exits, we could not have investment returns, and then not be able to raise new funds", said an investment manager at a large Beijing-based PE firm, who declined to be identified.

According to the China Securities Regulatory Commission, 83 companies have passed the examination of the agency's IPO committee and are waiting for the market to give an indication of their valuations.

Of this group, 50 are backed by 101 PE and VC firms, according to China Securities Journal.