Jewelry buyers cast golden glow on bullion in Q2

Low gold prices generated a surge in global jewelry demand to 575.5 metric tons, a five-year high, in the second quarter of 2013, according to data from the World Gold Council released on Thursday.

It revealed the average gold price for the second quarter of 2013 was $1,415 an ounce, down 12 percent year-on-year.

Analysts said that in China gold remains a compelling investment because the poorly performing stock market does not serve as an attractive investment option and concerns linger over the possibility of a domestic credit crisis.

Global jewelry demand rose 37 percent year-on-year in the second quarter of 2013 led by the Chinese and Indians. In value terms, demand showed a 20 percent year-on-year increase, the council said.

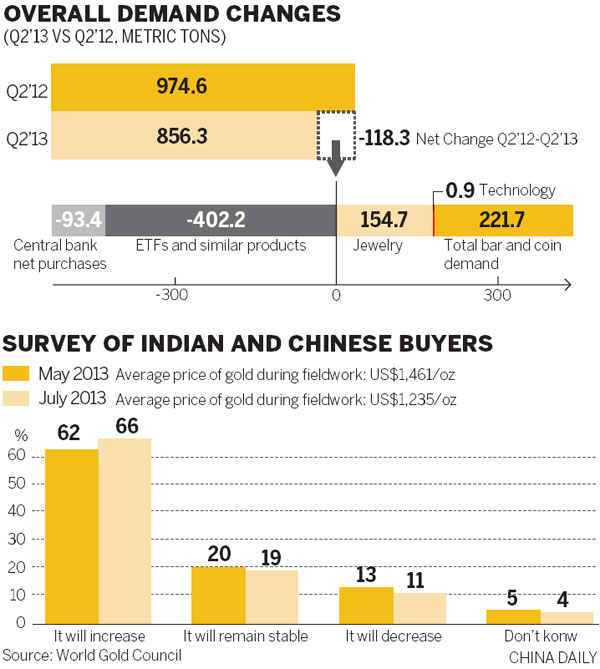

Outflows among exchange-traded funds dragged overall gold demand down to a three-year low in US dollar terms in the second quarter of 2013, according to the council's quarterly report.

"The second quarter continued the trend that we saw in the first - of a rebalancing in the market - as gold coming on to the market from ETF sales met with a wave of demand for bars and coins, as well as jewelry. This surge in bar and coin investment was a common theme in key markets around the world and has been particularly prominent in the world's biggest gold markets - India and China," said Marcus Grubb, managing director of investment at the council.

This shift from West to East has been further reinforced by recent data from the London Bullion Market Association showing that in June the volume of gold transferred between accounts held by bullion clearers hit a second consecutive 12-year high, buoyed by strong Asian physical demand, said Grubb.

"This quarter again demonstrates the unique diversity of global gold demand, in that the self-balancing nature of the market apparent in the previous quarter was even more clearly in evidence. Across the decades, different sectors in the gold market have risen in prominence at different points in the global economic cycle. The current shifts are just part of the normal ebb and flow of what is an extremely liquid market," said Grubb.

Second-quarter overall demand fell 12 percent year-on-year to 856.3 metric tons. In dollar terms, demand dropped 23 percent to $39 billion.

The biggest reason for the decline in demand came from a wave of outflows from exchange-traded funds after Western investors reacted to a "seemingly more positive outlook for the US economy and an eventual tapering of quantitative easing", according to the report.