China banking on tax reforms to help transform

How to reform?

Zhang Monan, an associate researcher with the State Information Center, says the present tax system does not give independent tax rights to local governments. Tax reforms should, she says, focus on granting certain tax rights to local governments and allow them to independently decide the size and structure of their budgetary expenditure.

|

|

|

Ongoing tax cut: Shanghai residents file their taxes at a local office in the country's financial capital. |

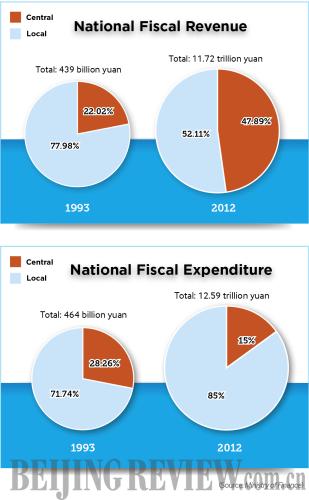

"China needs to redefine the distribution of tax revenue and fiscal expenditure between central and local governments, and change the pattern with land reserves as guaranty and bank credit as a major source of capital," said Zhang. "Local governments should have new sources of income to replace land-sourced fiscal revenue."

Jia Kang, Director of the Research Institute of Fiscal Science at the Ministry of Finance, says that there are three priorities. First, the functions and purpose of lower levels of government must change to avoid grandiose and wasteful spending and increasing debt levels.

Jia says both international and Chinese experience prove that a tax division system is necessary to develop a market economy. The problems confronting China in recent years have to do with a tax division system that hasn't been fully implemented.

Second, changes in how resources are taxed is needed to promote energy saving and sustainable development. Currently, prices for basic resource and primary products are seriously distorted. Jia says resource tax reform on crude oil and natural gas has begun across the country. Reform in future will cover more resources, particularly coal, which China consumes the most.

Third, tax reform should enhance wealth distribution to promote social harmony and common prosperity.

Good prospects

The fact that the pilot program to move from a business to a value-added tax has been extended to the whole country indicates that tax reform is looking optimistic.

The pilot in Jiangsu Province began on October 1, 2012, covering sectors of transportation, technology services, information technology, culture, logistics, etc. According to Jiangsu Provincial Department of Finance, this has been largely positive. First of all, the overall tax burden has been reduced. Within the 10 months since the pilot started, 9.55 billion yuan ($1.56 billion) in taxes were cut. As the project expands, domestic demand should increase and become a driver of economic growth.

Industrial upgrading—or the way businesses operate—has also witnessed significant change. The pilot project encourages companies to separate secondary businesses from core operations and therefore promote industrial specialization. For example, XCMG Group, a leading Chinese engineering machinery builder based in Jiangsu with a business turnover of 100 billion yuan ($16.33 billion) last year, has separated its transportation and logistics businesses and established several companies specialized in logistics. The group is strengthening its core business and expanding the scale of secondary dealings.

More importantly, the shift to a value-added tax both promotes the upgrading of traditional manufacturing technologies and encourages companies to innovate and purchase more advanced equipment, which is evident in the purchase rise of more sophisticated equipment during the pilot period in Jiangsu.

Changes likely coming to China's tax system will have a lasting impact on the country as a whole.

"From a strategic point of view, reform of China's tax system not only aims to reduce corporate taxes and improve the overall way taxes are collected, but more importantly promote the transformation of China's economic growth model, said Jia.