China plans to allow individuals to establish rural commercial banks as the country eases control over private capital in the banking sector, under a draft document from the China Banking Regulatory Commission.

The minimum registered capital for rural commercial banks is 50 million yuan ($8.2 million). Qualified originators include natural persons (that is, individuals), domestic non-financial institutes and domestic and overseas banks using internal capital, according to the draft.

"Fifty million yuan is not much for an individual who wants to enter the banking sector," said Qu Hongbin, chief of HSBC Holdings Plc, Asia Pacific. "It must be easy for many entrepreneurs or investors to come up with that amount."

|

A business hall of the Chaohu Rural Commercial Bank in Hefei, Anhui province. Apart from commercial banks, individuals will also be able to set up rural credit cooperatives, county-level banks or small lending associations. Xu Zhenhua / For China Daily |

Shares held by an individual may not exceed 2 percent of the total equity. Employees' combined stakeholding can't exceed 20 percent of the total equity.

Apart from commercial banks, individuals will also be able to set up rural credit cooperatives, county-level banks or small lending associations.

One threshold involving county-level banks has been lowered. The largest shareholder's stake should be at least 15 percent of the total equity, compared with 20 percent at present.

"The relaxation of controls is a good move toward opening the financial sector to more private capital," Qu added. "However, as reform deepens and interest rates are further freed up, tougher competition will reduce excessive returns in banking, which will fall to an average level."

Board members must have more than five years experience in law, economics, finance, or other sectors that would qualify them to carry out their responsibilities, according to the draft.

However, the credit sector remains closed to individuals. Loan providers shall be fully owned by domestic or overseas banks. But the requirement for at least 5 billion yuan in assets has been removed.

The draft imposes tighter restrictions on overseas originators or investors and adds two conditions. One is that their most recent year-end asset total must be at least 10 billion yuan. The second is that the capital adequacy ratio of commercial banks "shall be higher than the average level in the region where they are registered and not lower than 10.5 percent".

Moreover, individual foreign banks shall hold less than 20 percent of the equity in rural commercial banks, while multiple overseas banks' shares could not surpass 25 percent.

Asia Bike Trade Show kicks off in Nanjing

Asia Bike Trade Show kicks off in Nanjing

Student makes race car for 4th Formula SAE of China

Student makes race car for 4th Formula SAE of China

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

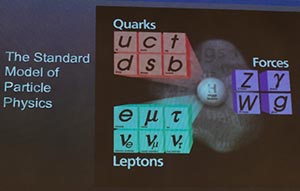

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists