The recent move of People's Bank of China to curtail the credit bubble in the inter-bank market underlines the authorities' desire to deleverage and reduce future financial risks. This is a clear warning to financial institutions. But while the authorities are likely to intervene, if needed, to stabilize the market, we think inter-bank rates could remain high for a long period.

Policymakers probably also hope to strengthen market discipline as a preparatory step toward interest rate and capital account liberalization. This implies that deleveraging is likely to continue and some of the smaller and weaker financial institutions may fail in the coming year.

Structural reforms: Since taking office, Li has been saying that reform is likely to pay the biggest policy dividends for the Chinese economy. While investors are anxiously waiting for the Third Plenum of the 18th CPC Central Committee in the fall for a clearer outline of economic policies, current policy discussions point to reforms in financial liberalization, the fiscal system, factor prices, land use rights, administrative controls, monopolies, income distribution and the hukou (household registration) system.

But many of these reforms, including the VAT on services, do not necessarily have to wait for the Third Plenum to be approved. In particular, financial liberalization is seeing renewed momentum-greater flexibility on deposit and lending rates, and in the deposit insurance system in the coming months.

The success of Likonomics will eventually depend on the effectiveness of structural reforms. But with the Chinese government preparing a wide range of reform measures, Li will be out to make his economic policy a success.

Likonomics is exactly what China needs to put its economy on a more sustainable path. And it is positive for the longer-term economic outlook, because unless the economy and markets face imminent risk of collapse, policymakers will not engage in aggressive fiscal or monetary expansion.

But, in the short run, such rebalancing and deleveraging point to further downside risks both for economic growth and asset prices, including the exchange rate. Based on an increasingly likely downside scenario, we think Chinese growth could experience a temporary "hard landing", which we would define as quarterly growth dropping to 3 percent or below, within the next three years. But such a slowdown would only be cyclical, and we would expect growth to bounce back dramatically afterwards.

The author is a professor at the National School of Development, Peking University, and former chief economist, Emerging Asia, Barclays Capital. This article draws from the author's joint report with Jian Chang and Joey Chew, "What to expect from Likonomics", June 27, 2013, Barclays Capital.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

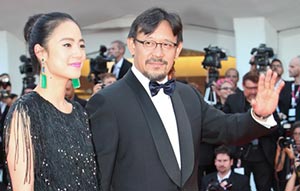

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant