|

An Industrial and Commercial Bank of China Ltd employee counts euros and yuan in Huaibei, Anhui province. China's surplus in its current account reached $49.8 billion in the fourth quarter of 2013. Xie Zhengyi / For China Daily |

Nation to relax outflows, encourage outbound investments, experts say

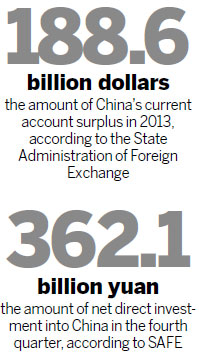

China recorded a $242.7 billion surplus in its capital and financial account and a $188.6 billion surplus in its current account in 2013, according to preliminary data released by the State Administration of Foreign Exchange on Friday.

It was a marked change from the $16.8 billion deficit in the capital and financial account in 2012.

The country had a $193.1 billion surplus in its current account that year.

SAFE said that in the fourth quarter, China had an $81 billion surplus on its capital and financial account, including a 362.1 billion yuan ($59 billion) net inflow of direct investment.

The surplus in its current account reached $49.8 billion.

The figures show that China is facing strong pressure from capital inflows, said Wen Bin, supervisor of macroeconomic research at the Bank of China's Institute of International Finance.

Therefore, the country will further open up its capital account and encourage outbound investments to achieve balance-of-payments equilibrium, Wen said.

During the first half of 2013, China experienced capital outflows as expectations for yuan depreciation increased. But after September, when the US Federal Reserve Board decided to hold off scaling back its quantitative easing program, foreign analysts began to feel more optimistic about China's economic growth.

At that point, international capital resumed flowing into China, which is a relatively stable emerging market, said Wen.

He added that China also attracted international capital due to interest rate differentials. For example, 10-year Chinese government bonds offered a yield of nearly 5 percent last year, well above the 2-3 percent yields on similar US government securities.

Capital arbitrage and inflows of short-term hot money in China have pushed up the yuan and forced the People's Bank of China to tighten monetary policy to prevent continued capital inflows from having a negative macroeconomic impact, said Wen.

He said the central government will undertake pilot programs allowing overseas investment by Chinese individuals and raising the annual limit on foreign exchange purchases by Chinese residents.