Surging borrowing costs are threatening China's economic growth this year, an economist from a top domestic think tank warned.

With growth momentum already slowing, Chinese enterprises will find their earnings increasingly insufficient to cover the cost of debt, with loan rates now exceeding 9 percent.

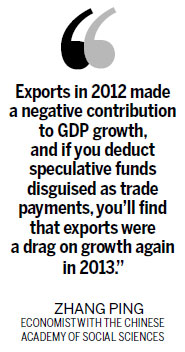

The situation inevitably raises the question of how the credit-dependent economy can keep expanding at the current pace, said Zhang Ping, deputy director of the Institute of Economics under the Chinese Academy of Social Sciences.

There's a dilemma facing the central bank, said Zhang.

If the People's Bank of China maintains a tight monetary stance and loan rates stay high, economic growth will be constrained.

Cash-starved companies will result in a contraction in business activity, with the Purchasing Managers' Index for manufacturing likely to slide below 50 in the second quarter.

If the PBOC loosens monetary policy to push down borrowing rates, it will have to achieve total social financing - a broad measure of liquidity - of more than 19 trillion yuan ($3.14 trillion) to support GDP growth of 7.5 percent.

But that amount of total social financing would represent 12 percent year-on-year expansion, much faster than last year's gain of 9 percent.

An increase of that scale will cause massive macroeconomic risk, Zhang said, because non-performing loans will pile up faster and the goal of reducing the economy's reliance on credit-fueled expansion will recede even further into the distance.

"To have more sustained and quality growth, we've got to let the growth rate go down," Zhang said.

He said that in addition to a rising dependency on credit expansion and skyrocketing real loan rates, another "abnormality" of the economy is that it's increasingly shifting toward growth fueled by "infrastructure and property industry".

Investment in these activities now accounts for the bulk of total investment. If the market slides and investment in these sectors loses momentum, investment growth will be endangered.