|

|

|

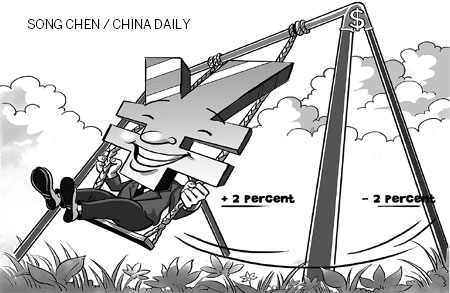

Following the recent depreciation, the band widening is a strong signal that policymakers are moving towards more exchange rate flexibility over time. More flexibility is crucial for the overall process of monetary and exchange rate reform-China needs greater exchange rate flexibility before further opening up its capital account to financial flows. It also helps breaking the perception of a one-way bet on the yuan. This has recently led to sizeable financial inflows that were complicating monetary and exchange rate policy and therefore frowned upon by financial policymakers.

However, we do not think much will change at the day to day level on China's foreign reserve market in the short term. The People's Bank of China will continue to set the fix-the center of the now enlarged band-at the beginning of every business day. Moreover, it will continue to heavily manage the spot rate. China has a structural surplus on the foreign reserve market of US dollar 300-400 billion per year-from the current account surplus and net FDI-which, at least in our forecast, will not easily go away in the coming years on current trends.

With a large structural surplus on the foreign reserve market, the yuan remains in the hands of policymakers. Net financial flows can at times be large enough to create temporary depreciation pressures, and the PBoC will be happy to let them exert temporary depreciation pressure. But, looking at the stock and composition of foreign assets and liabilities, the size of such net financial flows is simply not going to be large enough, compared with other balance of payment components, to drive the foreign reserve market.